Confidence is a great motivator – get a taste of it and you want more until little by little it builds into something that can be unstoppable. Moreover a person with confidence is more likely to succeed no matter what life may throw at them.

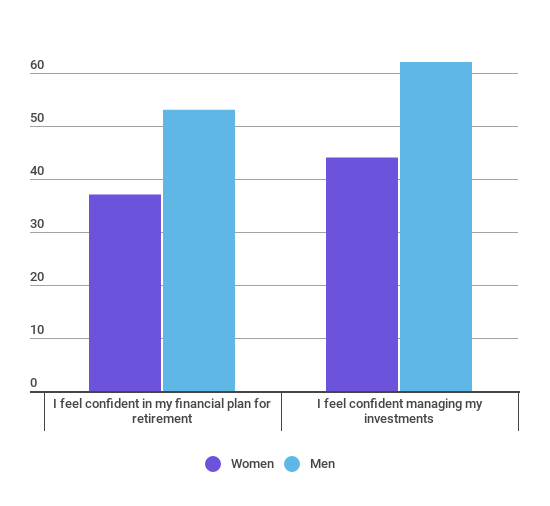

As such, it pains me to see a lack of confidence in women when compared to men in the areas of retirement planning and managing their investments.

We can point to extenuating circumstances as to why this may be the case:

- The gender pay gap means that men make more money, and therefore usually have higher average savings than compared to us, putting them on better financial footing

- The survey also mentioned the fact that men are more comfortable talking about the subject of money and finances with friends and family (70%) than we are (59%), which can lead to avoidance of the topic by us and procrastination to plan for our financial future

- Men’s confidence in other areas of their finances also breeds confidence in their ability to negotiate their salary, which would explain why 51% of men feel like they are getting paid what they are worth versus just 40% of us women

So how can women (or anyone) boost their confidence? It helps to have a plan for what you want to accomplish and how to achieve it. You can create a budget while setting clear financial goals and considering your options to achieve them.

Your confidence will likely rise as soon as you have a plan in place. Knowing what you want your money to do will help make it easier to ensure your financial choices bring you closer to your goals.

As we approach the end of 2018, and head into 2019, let’s make it our goal to increase our confidence when it comes to our personal finances. If we join the conversation, get more comfortable talking about our finances and plan for the things that we can control, little by little our confidence will rise until we are unstoppable.