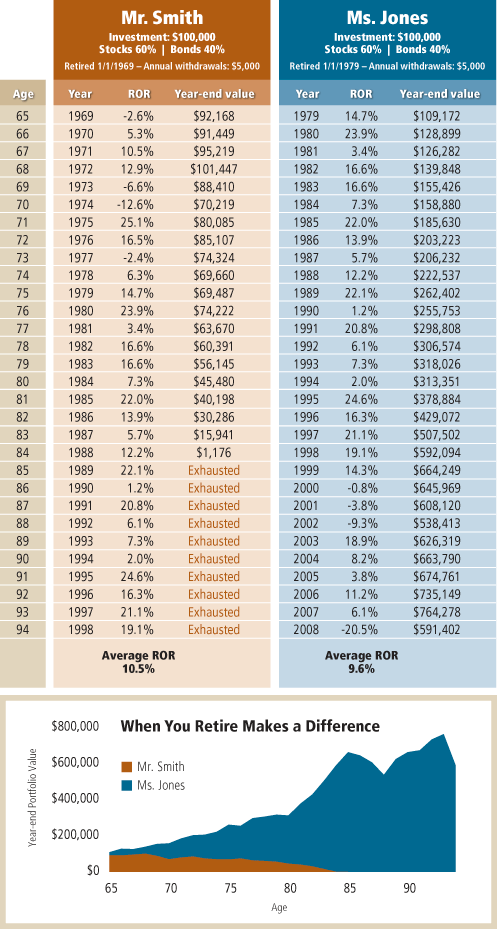

Most retirement plans are built on an assumed rate of return that is constant throughout your lifetime. Now we all know that in reality, that is not the way markets work, so what return you actually earn and when (i.e. sequence of returns) makes a huge difference to the viability of your plan. One key to combating sequence of returns risk is to have a plan and a process that continuously monitors that plan versus actual results. With regular check-ups, any potential damage done because of the sequence of returns can be mitigated by making necessary adjustments.

The following graphic does a great job of illustrating this point of why when you retire matters, and also how important it is to monitor your plan’s progress. What a difference 10 years makes…