For many older singles, there’s something far more pressing on their minds than putting a ring on it: financial security. People with a partner or spouse generally have someone helping out with expenses, as well as a built-in caregiver to lean on. For those who are single and childless, that lack of a default support system poses additional challenges as they age.

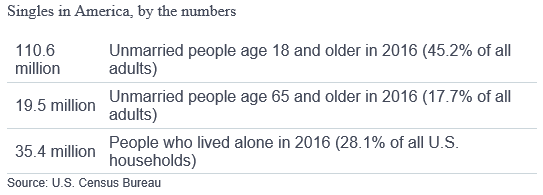

About 35.4 million Americans lived alone in 2016, comprising 28.1 percent of all U.S. households, according to the Census Bureau. The share of those age 65 or older is about 19.5 million people.

If you’re single and wondering whether there are aspects of retirement that you should prepare for beyond saving, the answer is yes. But let’s be practical first – of course, putting away as much as possible in a 401(k) plan or individual retirement account while you can is important. So is making sure you have emergency savings if you’re still working.

And, if you are still employed, it’s worth seeing if your company offers group insurance for long-term disability. Those policies provide a portion of your income in case you end up unable to work due to an accident or other medical condition.

Beyond saving and investing, here are some other key ways for singles to protect themselves as they age:

1. Estate Planning

While the central part of an estate plan is a will, there are a couple other components that become more important when you are single, regardless of your age. As you get older, however, the chance is greater that they will come into play.

First up is choosing someone to handle your finances if you reach a point where you cannot. Married couples typically name each other. For singles, choosing this person can be more challenging.

When you give someone durable power of attorney for your finances, that person will be in charge of paying bills, filing tax returns and the like. In other words, make sure you choose someone you can trust.

You also should give someone durable power of attorney for health care. That designation lets the chosen person make important health-care decisions if you cannot.

This is separate from a living will, which states your wishes if you are on life support or suffer from a terminal condition. This helps guide your proxy’s decision-making. And if you have no one named, medical personnel must follow your wishes in that document.

Remember, too, that if you pass away without a will dictating where you want your assets to go — called dying intestate — the courts in your state will decide who gets them, no matter how meager or sizable. Bottom line, if you care what happens to your money, you should make sure it goes where you want it to.

Be aware that retirement accounts and insurance policies will go to the named beneficiaries on them, regardless of what your will says. So make sure you keep those beneficiaries up to date.

The good news is that once you make these decisions, you don’t have to think about your estate plan too often. We recommend checking all aspects of it every three to five years unless you face a major life change or move to another state (laws affecting estate plans vary among jurisdictions).

2. Long-term care

If you’re single and have no family nearby who can step in if you reach a point where you need help with daily living activities like bathing and dressing, you’ll need to plan for how to pay for it.

Someone turning age 65 today has nearly a 70 percent chance of needing such long-term care in their remaining years, according to the Department of Health and Human Services. On average, women need care longer (3.7 years) than men (2.2 years).

It’s important to know that Medicare — which you generally sign up for when you’re 65 — typically doesn’t pay for long-term care. The cost of help can run well into six-figure territory, depending on the level of assistance and length of time provided.

If you have no family members to rely on and you don’t want to spend down your assets — and you’re above the income threshold to qualify for Medicaid — insurance for long-term care can be an option. In general terms, the insurance will pay a daily amount, up to a predetermined dollar limit and length of time, for services. However, policies can be expensive, costing upwards of $2,000 a year for younger applicants (in their 50s) and twice that for those over age 65. In other words, the younger you are when you consider it, the better.

3. Strengthen your social circle

When people are younger, their social network tends to be a thriving animal. As they age, however, that circle can get smaller.

While no one is saying you’d need to fill a dance hall with your list of friends, at least make sure you keep relationships alive and even strengthen them. When you’re older, they will become more important.

If you’re single and living alone, you won’t have someone to notice if, say, you fall or have another sort of medical emergency and can’t reach out for help. A strong social circle alleviates some of that worry, as you can have friends check on you. Additionally working part-time or volunteering to stay involved with others is also a way to continue your social habits. Not only does it keep you engaged with others, but you now have people that know you should show up at a certain place at a certain time.