A recent survey released by human resources consulting firm Aon Hewitt added further to the evidence that student loan debt has a detrimental effect on retirement security.

The survey found that:

- Employees with student loans participate in company retirement plans at a lower rate than those who don’t (71 percent vs. 77 percent)

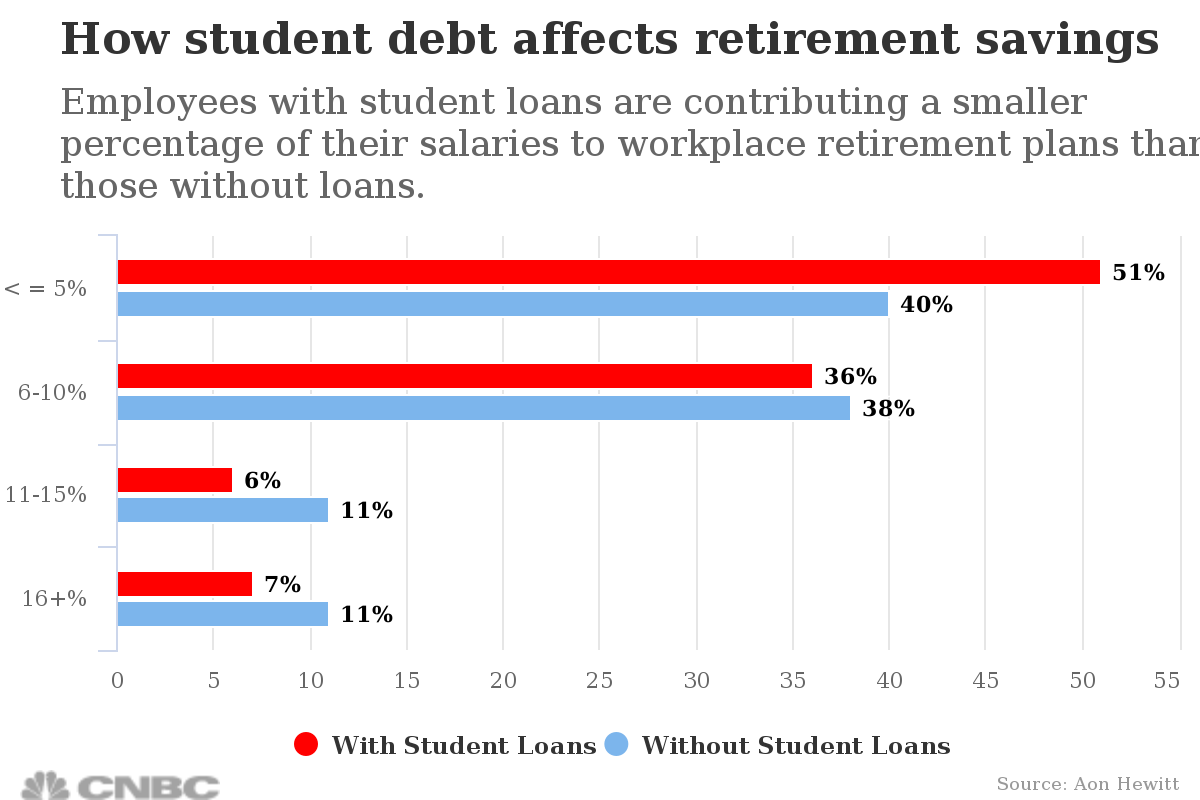

- Employees with student loans tend to contribute less to those plans; in fact, a majority contribute 5 percent or less

What does that drag on contributions actually amount to? Consider that there are usually 2 elements at work when considering your contribution level – what you are saving and what your company matches for your saving.

According to Aon Hewitt, the most common matching contribution employers give to a retirement plan is 6 percent of an employee’s salary. In order to receive the full amount, workers must commit to saving at least 6 percent. However, the majority of employees with student loans are only saving 5 percent or less, which means they are leaving free money on the table that their employer would contribute on behalf of their retirement.

The small differences in plan contributions can add up over a lifetime.

Take this example: A 30-year-old worker saving only 4 percent of pay because of her student loans will have accumulated a 401(k) plan balance of $351,407 at age 65, assuming matching employer contributions, a 2 percent raise every year and an annualized 6 percent in investment returns.

If the same worker saved 6 percent of their salary, she would have a balance of $527,110. That’s the difference of more than $175,703!

Source: http://www.cnbc.com/2016/10/19/student-loans-can-smother-your-retirement-savings.html