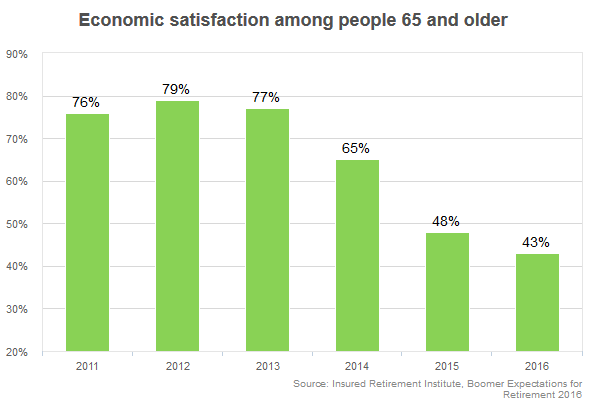

Below is a chart generated by the Insured Retirement Institute (IRI) detailing the economic satisfaction of the 65 and older crowd over the last 5 years and year-to-date 2016. The chart and corresponding article were recently posted at Bankrate.com. At quick glance, the first thing to strike you is the direction that satisfaction is heading – in one word down.

If you’re approaching retirement and share some of the same fears identified below, pay close attention to the suggestions offered to “fix the problem.” Being proactive when it comes to securing your retirement ensures a more certain, and satisfying, outcome.

———————————————————————-

By Jennie L. Phipps

Considering that the economy appears to be more stable than it was 5 years ago, why are boomers more fearful rather than less? Members of a panel assembled by the IRI to analyze this study offered these 6 reasons:

- Savings aren’t growing because interest rates are so low. People may be saving, but they aren’t getting what it takes to grow their nest egg says.

- The recession was long and discouraging. Though we’ve been on the upswing, the length of the recession took a toll on boomers. Many were laid off or had to retire early because of transitions in the workplace.

- Grown children and parents are moving back in. Many a boomer has joined the Sandwich Generation. They’ve had to take in their children, grandchildren and maybe even parents to their households.

- Health care costs are rising. Fear of the unknown — how much will health care really cost — is particularly daunting.

- Bad news about the economy abounds. We haven’t seen a drop in preparedness, but consumers are more aware of potential problems.

- People are bombarded with complexity. You used to get your pension and Social Security checks and that was it. Today, people have to be a lot more educated to plan adequately for retirement. And for many, confidence drops based on confusion.

Fixing the problem

The 6th annual survey was released just in time for National Retirement Planning Week. Right or wrong, this appears to be the way life is, so what can boomers do to ease their minds?

Here are 6 suggestions. All of them have been said many times before. Nevertheless, actually doing them can make a big difference in your ability to retire comfortably.

-

Make a plan. Any old plan won’t do it. What you need is a written, comprehensive plan. It greatly improves your knowledge and your likelihood of success.

-

Save in a tax-advantaged retirement plan. If you are entitled to an old-fashioned pension, you’re lucky. If you’re not — and even if you are — save early and often.

-

Be realistic about retirement timing. People are saying they expect to retire later, but perception differs from reality. Research shows you need 2 things to keep working once you reach retirement age: a financial need to keep working and you have to enjoy your job. If you don’t have both of those things, the likelihood you’ll keep working is about 0.

-

Understand Social Security. For two-thirds of boomers, Social Security will provide more than 50% of retirement income. The takeaway, you have to make good Social Security decisions.

-

Take advantage of home equity. If you have it, focus on ways to use it to your best advantage. It is potentially an untapped and unplanned resource.

-

Get good advice. Smart retirement advice can make all the difference.