Although you may have done a noble job of planning for your retirement, approaching age 65 is still full of complexities—including how your healthcare coverage will change and how you will pay for it.

According to recent research released by Fidelity, conducted with the Stanford Center on Longevity, people retire an average of 4 years sooner than they had planned. For many who do have gap years between when they actually retired and when they had planned to retire, it can be a mad scramble to find affordable, quality healthcare coverage until they are eligible for Medicare at age 65.

With more and more employers dropping their pre-65 retiree medical plans, the questions of where and how to get the right coverage if you retire prior to Medicare eligibility did not disappear with the Affordable Care Act, and may still create indecision and uncertainty in someone who is otherwise ready to retire.

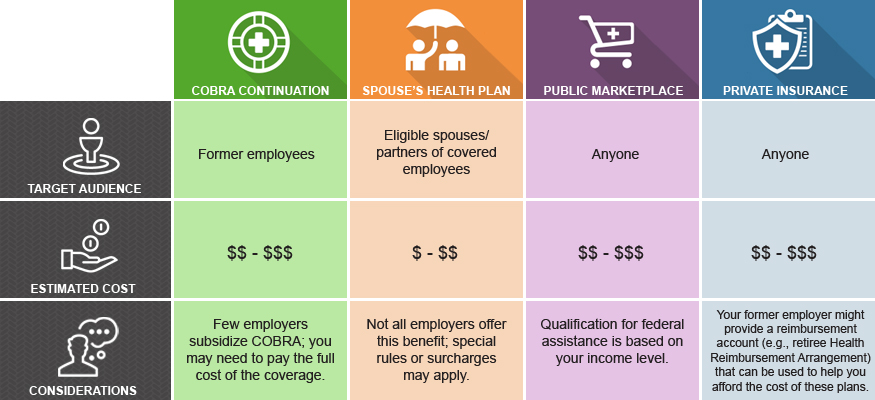

If you are retiring before you’re 65 and don’t have access to retiree healthcare coverage from your employer, there are 4 main ways to obtain healthcare coverage to bridge the period between retirement and Medicare:

COBRA coverage. The Consolidated Omnibus Budget Reconciliation Act of 1985, or COBRA, allows you to continue your current healthcare coverage for a certain amount of time, but you may be required to pay the full cost of your health coverage plus an additional 2% charge. Meaning premium costs can quickly add up. While you are working, your employer will typically cover a significant portion of the cost of your coverage, reducing the cost for active employees, but that is rarely the case for those who continue coverage through COBRA.

Spouse’s plan. If your spouse or partner is employed and has health coverage, you may be able to get covered on their employer’s plan—and this may be your best and most cost-effective option. If your spouse or partner is already retired and has retiree medical coverage, you may be able to be added to that coverage as well.

Public marketplace. The marketplace was established by the Affordable Care Act and provides plan options available to anyone who is not yet eligible for Medicare. You can no longer be denied coverage for any reason, including a pre-existing condition. This was often a significant issue for those contemplating early retirement because affordable health insurance coverage was hard to find and obtain, particularly for those with pre-existing medical conditions. Costs for these plans can vary widely, but some people qualify for government-provided subsidies through premium tax credits that can make the coverage more affordable.

Private insurance. To obtain coverage, you can also look to your local health insurance agent, trade or professional associations, and other so-called “private exchanges” that offer plans from multiple carriers. You may have more plan options available to you through these outlets than the public marketplace, but note that government-funded premium tax credits cannot be applied to these plans.

The public marketplace is usually a good outlet for pre-65 retirees who do not have access to an employer-sponsored retiree medical plan, but these exchanges are still very new and many insurance companies have withdrawn from the market. On a more positive note, there are other outlets available to you, such as private exchanges, which can offer coverage regardless of your health status.

Bottom line, when retiring prior to Medicare eligibility at age 65, how you’ll cover your healthcare and the costs associated with this decision are huge factors of your retirement plan. Carefully consider its impact if early retirement is your goal.