At first blush, the term “pro rata” sounds like the worst type of inscrutable legalese. But it’s an important concept for investors, especially for those considering IRA conversions or mulling their distribution options from their retirement plans. Gaining a working knowledge of the “pro rata” rules and the various ways in which they affect you can help you avoid costly errors while maximizing your take-home returns.

Two Key Applications for Pro Rata Rules

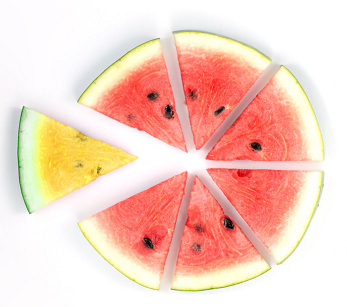

Pro rata is a Latin term that means “in proportion.” To use a simple example of pro rata in action, if I go out with a friend and she orders three drinks and I have just one, and our total bill is $40, her pro rata share of the bill would be $30 and mine would be $10. (That assumes, of course, that the drinks were roughly equal in price, and we don’t want anyone to go home mad.)

Pro rata has two key applications for investors. The first applies to the tax treatment of distributions from traditional IRAs (or SEP/SIMPLE IRAs), as well as the tax treatment of nonqualified 529 withdrawals. Pro rata rules can also apply to the asset allocation of withdrawals from a company retirement plan–that is, the pro rata rules may limit a retiree’s ability to pick and choose which specific investments they’re selling to meet his distribution goals.

‘Cream in the Coffee’

Let’s start by looking at the pro rata rules as they apply to traditional IRA distributions and conversions. (NOTE: Roth IRA assets aren’t subject to the pro rata rule.) To understand how they work, it’s helpful to review the two key tax types of assets that can be found in a traditional IRA.

The first category is money that has never been taxed: contributions that an investor deducted on his tax return, assets that were rolled over from a traditional 401(k) or other retirement plan (such contributions are made on a pretax basis and appreciation is tax-deferred), and investment appreciation on assets held inside of the IRA. Because those dollars have never been taxed, they’re fully taxable at the investor’s ordinary income tax rate upon withdrawal. For most investors with traditional IRA assets, their IRA assets have never been taxed, so will be fully taxable upon distribution.

The second category of traditional IRA assets consists of money that has already been taxed, mainly nondeductible contributions made directly to the traditional IRA. (Investors may also have made after-tax contributions to their 401(k)s and rolled them into their IRAs, but now such monies can be shunted directly into a Roth IRA, effectively avoiding the pro rata rule). Those nondeductible IRA contributions have already been taxed, so the investor shouldn’t owe taxes on them again. Not surprisingly, these already taxed assets are much less commonly found in IRAs; they typically only apply to high-income earners who cannot deduct a traditional IRA contribution or make a Roth IRA contribution. For such individuals, their only avenue to having any sort of IRA is to make a nondeductible IRA contribution.

The pro rata rule comes into play if the investor has a combination of traditional IRA assets in both tax categories: never-been-taxed money and already-been-taxed money. When it comes to distributions and conversions of such “blended” asset pools, the IRS looks at the ratio of never-been-taxed and already-been-taxed assets in the whole kitty to determine the tax treatment of each distribution/conversion. Tax experts call it the “cream in the coffee” rule. That alludes to the fact that once after-tax dollars are in the mix (the “cream”), you can’t extract them on their own–even though that might be more advantageous from a tax standpoint. They’re already blended into the coffee.

Let’s look at a simple–and common–example to illustrate. Let’s say Hank has $500,000 in a traditional IRA. Of that amount, $400,000 was rolled over from his former employer’s 401(k); that money was never taxed because he made pretax contributions and has enjoyed tax-deferred compounding on his dough, both when it was in the 401(k) and now that it’s in the IRA. The other $100,000 consists of IRA contributions that he made directly to an IRA; he couldn’t deduct those IRA contributions because his earnings were too high. When he starts taking distributions, he won’t have the latitude to pick and choose whether he draws from the never-been-taxed pool or the already-been-taxed pool; rather, each of his distributions would be 80% taxable, because 80% of his total IRA kitty ($400,000 of his $500,000 balance) has never been taxed. That’s the pro rata rule in action.

Backdoor Roth IRA Contributions Can Be Partially Taxable, Too

The pro rata rule can also come into play when determining the tax treatment of conversions from traditional IRAs to Roth, an issue that has come into sharp relief with the uptake of the “backdoor Roth IRA.” The backdoor IRA maneuver allows high-income earners, who are shut out of direct Roth IRA contributions due to income limits, to make traditional nondeductible IRA contributions and then convert those assets to Roth shortly thereafter. (There are no income limits on conversions.) Voila–Roth IRA!

For investors who have no other traditional IRA assets that have never been taxed (such as assets rolled over from a former employer’s 401(k) or deductible IRA contributions they made when their incomes were lower), the backdoor IRA maneuver should be entirely or mostly tax-free. After all, the money they put into the traditional IRA was already taxed, and assuming the investments within the IRA didn’t rack up big gains from the time the investor funded the IRA to when it was converted, there shouldn’t be much in the way of taxable investment appreciation to worry about, either.

The cream gets into the coffee, however, for backdoor IRA converters who do have traditional IRA kitties consisting of never-been-taxed dollars. Let’s say, for example, that Samantha steers $6,000 into a nondeductible IRA with an eye toward converting those assets to Roth. She also has $300,000 in a Traditional IRA, however; she rolled that money over from her old 401(k) plan when she changed jobs, so that money has never been taxed. Even though she only wants to convert the new $6,000 IRA to Roth, she’ll run into the pro rata rule; because $6,000 is just a tiny fraction of her $306,000 IRA kitty, she’ll owe taxes on roughly 98% of the $6,000 that she converts to Roth.

That’s a key reason why the backdoor IRA is typically best used by investors who don’t have a lot of other traditional IRA assets on the side. But there’s also a workaround worth considering for would-be backdoor Roth IRA contributors–namely, rolling the never-been-taxed traditional IRA assets into an employer’s 401(k) plan. That effectively removes those assets from the IRA kitty, so that converting the new IRA to Roth would trigger limited tax consequences, as discussed above. Of course the wisdom of that maneuver depends on the quality of the company retirement plan, as well as whether it offers the “roll-in” of external assets in the first place.

529s May Also Be Affected

Although it’s less common, the pro rata rule also comes into play for 529 withdrawals if they’re not used for qualified college expenses. In such an instance, the whole withdrawal is not taxed; that’s only fair because 529 contributions consist of after-tax dollars. Rather, the taxation of such withdrawals is based on the ratio between earnings (never been taxed) and principal/contributions (already taxed). Yet college-savers should aim to avoid such distributions if they can; in addition to paying ordinary income tax on the percentage of the nonqualified withdrawal that’s attributable to investment gains, a 10% penalty applies unless the situation fits with one of the exceptions:

- Beneficiary passes away or becomes disabled

- Beneficiary receives tax-free tuition assistance

- Beneficiary attends a U.S. military academy

- Beneficiary receives assistance from an employer

Moreover, if the 529 contributor received a state tax deduction or credit on the contribution, the state may “claw back” the unpaid taxes if the monies weren’t used for college.