The approach of a milestone birthday is a reminder that, as life changes, so do your needs and circumstances. With the “Big Five-O,” the question is settled: You’re no longer a kid. And that’s a great thing; maturity is much better than it’s cracked up to be. So, instead of dreading it, update your financial life by hitting the following targets and embrace the coming decades as you prepare for retirement.

1. Debt: Tamed

Maybe it’s maturity, or maybe it’s the prospect of dragging debts through your so-called golden years, but you have paid off your debts or have them under control.

You add new debt only when you can easily handle it. You pay credit card balances before interest is applied.

2. Spending: Under control

With children possibly gone from the home and maybe even out of school, you may have more money on hand now. It’s tempting to spend it. After all, your friends may be living it up, and you’ve worked hard to get here.

Have fun, but don’t shortchange your retirement goals. If you are well-employed, your 50s are a gift — probably the best earning years of your life. Double down on savings, as retirement may last a long, long time.

Also, start thinking about how you’ll change your spending after retirement.

3. Retirement goals: Defined

Set a concrete goal for your retirement savings. Just do it. The kids will find a way to pay for college if it matters to them. They have years to get on their feet financially. You do not. Set a retirement income goal now so that, if you are short financially, there’s time to improve things.

There are a couple of approaches. One is to set your goal for the amount of money that many investment professionals suggest you should save by retirement: 10 to 12 times the amount of your last full year of income.

Say, for example, that you expect to make $80,000 the last year that you work. Under this guideline, you would need to set aside $800,000 to $960,000 for retirement.

Another approach is to see how far your current retirement savings will take you. Online calculators can help you compute this — just don’t bank on a calculator’s answer.

4. Retirement contributions: Inching up steadily

Now that you have a goal, keep increasing the percentage of each paycheck that you save for retirement. Make the increases so small they’re hardly noticeable.

If you’re currently diverting 12 percent to a retirement account like a 401(k) or IRA, bump it up to 13 percent. Six months later, give your retirement savings another tiny raise and keep it going until you are at your goal. Ditto if you’re saving 6 percent: Inch it up to 7 percent, and then onward.

Whatever your goal, automate the deductions from your paycheck, so you never see the money.

5. 401(k): Lowest fees possible

Fees paid to manage retirement savings may appear low. “What’s 3.5 percent but a drop in the bucket?” you think. Well, you think wrong!

Many savers unknowingly pay far too much in mutual fund fees, losing tens or hundreds of thousands of dollars they could have used in retirement.

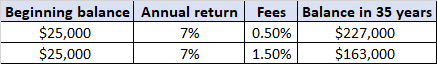

An example from the U.S. Department of Labor shows how fees affect two balances of $25,000 apiece, given no additional contributions. One balance is subject to 1 percentage point more in fees than the other — but the resulting difference in the two balances after 35 years is $64,000:

Check your plan statements to see the fees you are charged.

6. Your will: Updated

If you don’t have a will, a probate court will decide what to do with your assets after you die.

If you want control over what happens to your money and property, you need a will. And your spouse should have a separate will. A will gives voice to your decisions and requests after you’re gone.

Use it to say what you want for your children and pets. Use it to determine what happens to any of your possessions with financial or sentimental value. You can include provisions for your remains and, if you want one, name an executor who will be in charge of following your directions.

Depending on your situation, you may even want to consider creating a trust, which allows you to bypass the courts and probate, and pass your assets in a more timely and efficient manner. Speak to an estate planning expert if you’re not sure what best fits your situation and needs.

7. Long-term care: A plan in mind

By our 50th birthday, it occurs to many of us that maybe — just maybe — we really will get old. Since many of us will end up needing skilled nursing care at least for a short time in our old age, managing your finances requires considering how to pay for it.

Long-term care insurance can be an excellent tool. But whether it’s right for you depends on several things. If you’re not sure long-term care insurance makes sense for you, work with an expert to determine what works best for your situation.

8. Mortgage: End in sight

Entering retirement with a paid-off mortgage is a smart goal. Tearing up the mortgage before retirement was commonplace a couple of generations ago. Not everyone can pull it off these days, but the rewards are great.

You’ll require less income. If your mortgage eats a quarter or more of your monthly pay, you’ll effectively enjoy a raise of that much.

9. Insurance: Reviewed and adjusted accordingly

Life changes, and so should your insurance. If your children or spouse would be lost without your salary, get enough life insurance to carry them through if you die. When your children are launched in careers and you and your spouse are nearer retirement, you may be able to drop your life insurance policy.

If losing your salary would be financially devastating, cover the risk with disability insurance.

Lastly, take a look at your health insurance policy and home and auto insurance limits, too. Is the coverage still appropriate?