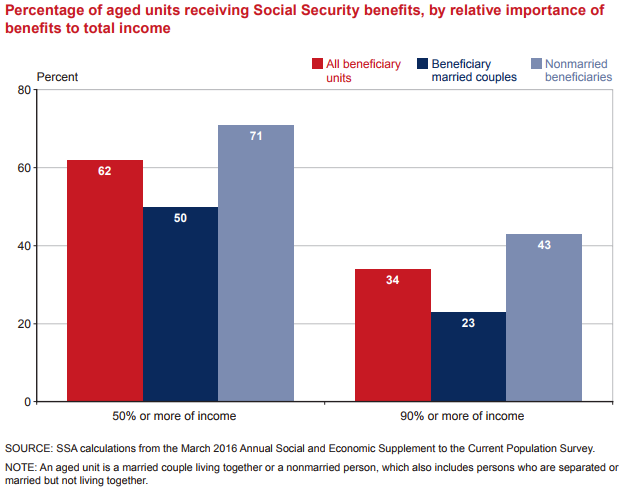

According to the Social Security Administration, half of married couples count on Social Security for at least half of their income. The numbers are even higher for non-married recipients:

A significant portion of non-married retirees are widows and widowers, many of whom see their household income fall sharply when their spouse died. Why? Consider that when one spouse dies, the surviving spouse will be able to continue receiving an amount equal to either their Social Security benefit or their spouse’s if it was higher — but not both. Many pensions work the same way, with surviving spouses often getting a reduced — or even no — benefit. So when before there were two incomes coming in, now there is just one, or at worst case the source disappears entirely.

This means many people will see their household income fall more than their cost of living does when their spouse dies. As a result, your retirement plan should address this issue if Social Security or pension benefits make up a significant portion of your retirement income. If retiring today would potentially put your spouse in dire financial straits if they outlive you by a substantial number of years, you may want to consider delaying retirement and must plan accordingly to ensure a secure retirement for both of you.