In life, our biggest regrets are often things we didn’t do rather than what we did – not spending enough time with family, not seeing the world as much as we would have liked, or not going after the “dream job” and settling for the safe one.

This also holds true for some of our biggest financial regrets. And for seniors, when they look back on their financial decision, too often one – if not the biggest – regret is not saving for retirement early enough. A recent survey by Bankrate seems to back up this claim.

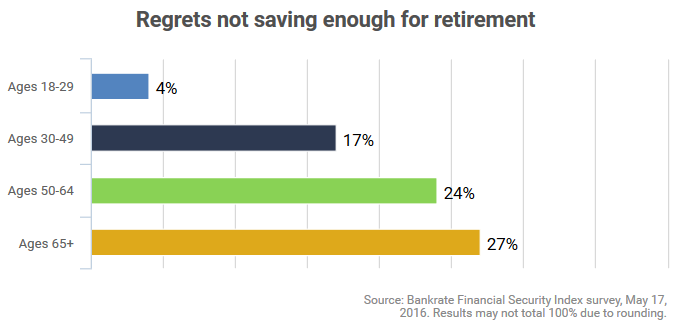

Over a quarter of respondents age 65 or older said they most regret not saving for retirement sooner in life. Even more telling is that regrets about not saving for retirement early enough grew very consistently by age. This increasing level of regretfulness as one gets older could be explained by the statistics shared below from the Economic Policy Institute’s latest “The State of American Retirement” report, which paints a picture of retirement wealth falling well short for many Americans:

- Average retirement savings for American families is $95,776

- Nearly half of families have no retirement savings at all

- For those with savings accounts, the median savings is $60,000

- With retirement savings varying widely by age, the median savings for families in their mid-30s is $480 and for those nearing retirement, the median savings is $17,000

The major takeaway: to avoid becoming part of that 27% later in life, start saving for retirement now. To do this, make savings a habit (automated whenever possible), not an afterthought. Take advantage of company sponsored retirement plans and open an IRA if your employer does not have one. If you make it a point to live well within your means so that savings does not become a burden, your older self will thank you.