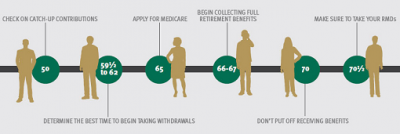

Sharing the following from Next Avenue, courtesy of Emily Brandon’s new book, Pensionless. It’s a great summary of key ages and dates important to the retirement planning timeline. These ages and dates are like mile markers on your retirement road-map. Knowing the ramifications associated with each (i.e. the ability to contribute more, the age at which you can start taking benefits without penalty, the age and time by which you need to make distributions from your retirement accounts) are critical to one’s decision-making process about and in retirement.

——————————————

Age 50 Workers age 50 and older are eligible to make catch-up contributions to their 401(k) and IRA accounts. Older workers can defer taxes on as much as $24,000 in 401(k) plans and $6,500 in IRAs in 2016, which is $6,000 and $1,000 more, respectively, than the amounts for younger employees.

Age 55 People who lose or leave their jobs in the calendar year they turn 55 or later won’t have to pay the early withdrawal penalty on distributions from the 401(k) plan from their most recent job.

Age 59 ½ There’s no longer a 10 percent early withdrawal penalty on 401(k) and IRA distributions for you.

Age 62 You can claim Social Security benefits beginning at 62, but payments are permanently reduced if you sign up at this age. If you work and collect Social Security benefits at the same time, part or all of your benefit payments could be temporarily withheld.

Age 65 The seven-month initial enrollment period for Medicare begins three months before your 65th birthday. If you don’t sign up on time, your Medicare Part B and D premiums could permanently increase, and you could be denied the opportunity to purchase supplemental coverage. If you are still working at 65, you need to sign up within eight months of leaving the job or group health insurance plan to avoid the higher premiums.

Age 66 You can begin to collect the entire Social Security benefit you have earned at your Full Retirement Age, which is 66 for boomers born between 1943 and 1954. The Full Retirement Age increases from 66 and two months for people born in 1955 to 66 and 10 months for workers born in 1959. At Full retirement Age and older, Social Security benefits are no longer withheld if you work and collect Social Security benefits simultaneously.

Age 67 That’s the Social Security Full Retirement Age for people born in 1960 or later.

Age 70 Social Security payments further increase by about 8 percent per year for workers who delay claiming them up until 70. After 70, there is no additional benefit for waiting to claim Social Security.

Age 70 ½ Distributions from traditional IRAs, 401(k)s and Roth 401(k)s are required after this age. Income tax will be due on withdrawals from traditional retirement accounts, but not Roth IRAs. Employed individuals who don’t own 5 percent or more of the company they work for can delay distributions from their current 401(k) until April 1 of the year after they retire. Investors age 70 ½ and older are no longer eligible for a tax deduction on their traditional IRA contributions.

December 31 401(k) contributions typically need to be made by the end of the calendar year. Required minimum distributions from retirement accounts (except for the first one) must also be taken by December 31 each year to avoid a 50 percent tax penalty on the amount that should have been withdrawn.

April 1 You can delay your first required minimum distribution from a 401(k) or IRA until April 1 of the year after you turn 70 ½. However, your second and all subsequent distributions will be due by December 31 annually. So, delaying your first distribution will require you to take two distributions in the same year, which could result in an unusually high tax bill that year.

April 15 You can make IRA contributions until your tax filing deadline, which is typically around April 15 each year. Contributing to an IRA in April can result in nearly immediate tax savings on your current bill.

October 15 to December 7 Medicare Part D beneficiaries have the option to switch plans (do this at the Medicare site – LINK http://www.medicare.gov/find-a-plan) between October 15 and December 7 each year during the annual enrollment period. During this time period you should check that the medications you need will continue to be covered at an affordable price. If they will not be, consider switching plans.

You can also join a Medicare Advantage plan or switch back to original Medicare. If you swap plans, your new coverage will begin on January 1. Meeting these deadlines is crucial for your retirement planning success. If you don’t take action by a specific date or age, you could trigger penalties or fees or miss out on a valuable retirement benefit you could have gotten.

Source: http://www.nextavenue.org/critical-ages-and-dates-for-your-retirement-planning/