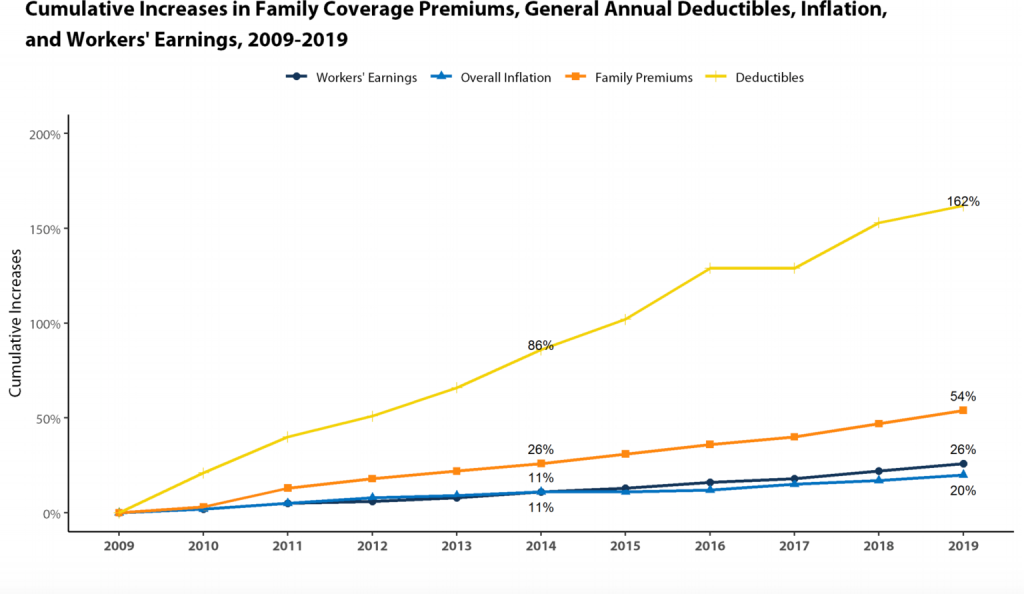

When people say that you can’t squeeze blood out of a turnip, it means that you cannot get something from a person, especially money, that they don’t have. Such is the unfortunate case of the trajectory of healthcare costs and wages in the United States. The graphic and article below highlight the treacherous path we are on when it comes to healthcare expenses. While we see costs continue to rise (far outpacing inflation for other goods and services), wage growth is not keeping up. It’s no wonder that fear of unknown healthcare costs continues to crop up as a top threat to people’s financial and retirement security.

———————————

The average deductible for an individual is $1,655 a year, roughly double the $826 workers paid about a decade ago, according to the Kaiser Family Foundation’s annual Employer Health Benefits Survey released Wednesday.

A greater number of employees have deductibles compared with a decade ago, too. A little more than four of every five covered workers have a deductible, more than the 63% of workers who had deductibles a decade ago.

For a family insurance plan, employers and workers pay a total of $20,576 a year in insurance premiums. Of that, workers are annually contributing $6,015, an amount that’s also rising.

The increase in medical expenses is coming at a faster pace than both wage growth and inflation. In the past year, annual family premiums rose by 5% while wages rose 3.4% and inflation rose 2%.

While wages and inflation have cumulatively increased 26% and 20%, premiums are cumulatively up 54% over the past decade, while deductibles have skyrocketed 162%.