Passing along this excellent article by Charlie Bilello. In it, he makes the case as to why focusing on saving is a far more powerful way to secure your financial future than investing. Though both are important to achieving your personal finance goals, for one thing, your personal savings rate is much more under your own control as opposed to the markets in which you choose to invest. Even more telling is the difference a 1% increase to savings vs. a 1% increase to rate of return has on your ending balance. As his math proves, you are much better off finding ways to increase your savings rate rather than stretching your risk for an incrementally higher return.

—————————————————-

What matters more – your personal savings rate or your investing rate of return?

Your instinct is probably to say the latter, as that is what gets far more attention. We are often thinking about how we can make a higher return; we rarely think about saving more.

In reality, though, saving is far more important for the majority of Americans.

Why?

Because most people don’t save very much at all, and without savings you cannot invest. That is true whether you make $25,000 a year or $250,000 a year. If you spend everything you make, you’re left with nothing to invest.

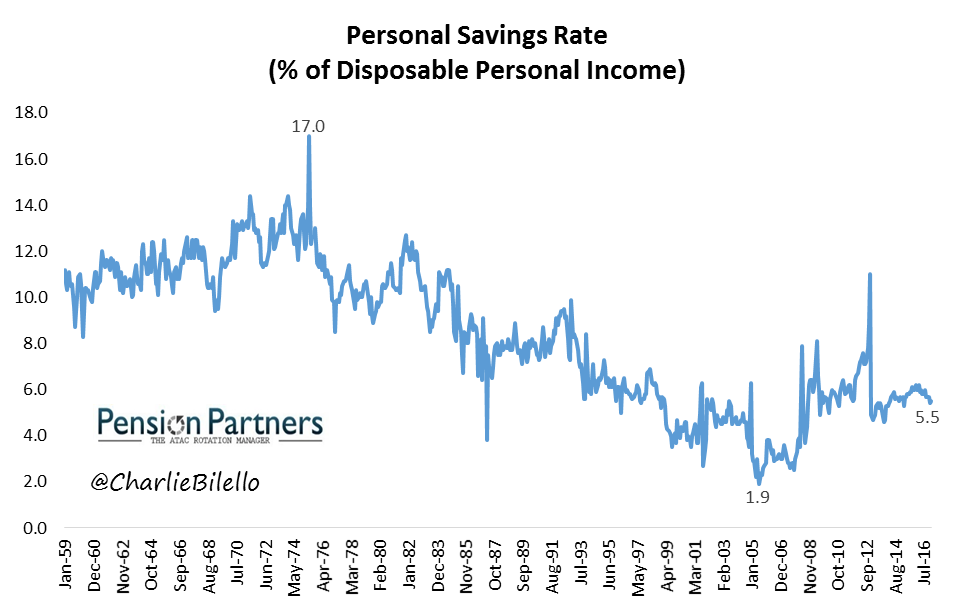

In the U.S. today, the personal savings rate is 5.5%, calculated as follows:

(personal income less personal outlays and personal current taxes) / (disposable personal income)

The 5.5% is an aggregate number. Most Americans fall far short. Some startling figures:

- 62% of Americans have less than $1,000 in a savings account. Even at higher income levels of between $100,000 and $149,999, 44% had less than $1,000. See here.

- 66 million Americans have zero dollars saved in an emergency fund. 47% of Americans could not afford an emergency expense of $400. See here.

- 43% of working-age families have no retirement savings at all. The median working-age couple has saved only $5,000 for retirement. 70% of couples have less than $50,000 saved. See here.

- 65% of credit card users carry a balance (don’t pay off their bill every month), paying an average interest rate of over 15%. The average credit card debt for households that carry a balance is $16,048. See here and here.

I could on and on with these statistics, but you get the point. The vast majority of Americans are saving very little. By extension, they are investing very little. By further extension, their rate of return on said investments is not nearly as important as their savings rate.

Let’s go through some numbers to make this point clearer. The median household income in the U.S. is around $58,000. Assuming an effective tax rate (federal/state) of 15%, this leaves disposable income of $49,300.

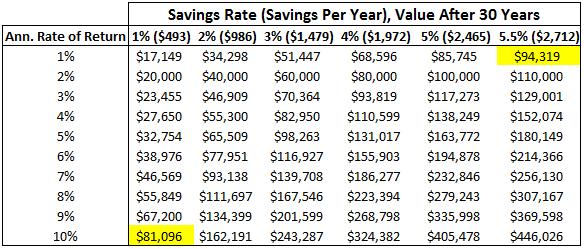

If we assume various savings rates on this $49,300 (1% to 5.5%) and various returns (1% to 10% annualized), where does this leave the average household after 30 years (to simplify, we’ll assume no taxes and no inflation)? Was it more important to earn a higher return, or to save more?

The answer may surprise you.

If the average household saves 1% per year and earns a 10% rate of return, they are left with $81,096 after 30 years. If they instead save 5.5% per year (the national average) and earn only a 1% rate of return, they are left with a higher balance: $94,319.

Note: Table Assumes No Taxes/Inflation

To further illustrate, let’s compare a 1% increase in your rate of return versus a 1% increase in your savings rate:

- If the average household saves 1% per year and earns a 5% return per year, after 30 years they are left with $32,754. A 6% return would bump this up to $38,976, a 19% increase.

- By comparison, if instead of earning 1% more on their money they were able to save 1% more per year, they are left with $65,509 after 30 years. This is a 100% increase.

Clearly, savings seems to trump investing returns for the average American household. This is good news, for saving more is something you actually can control, whereas earning a higher rate of return is infinitesimally more difficult.

That’s not to say that saving more is easy. Far from it, especially when the median household income has struggled to keep pace with inflation over the past 20 years. It takes discipline, hard choices, and saying no to a lot of things. This doesn’t sound like very much fun, but if you want to build wealth, there is no other way.

When millennials ask me about investing, I tell them to first think about saving. That starts with eliminating high interest rate credit card debt, which is the best investment you can make. If you have high interest rate auto loans or student loans, it may apply here as well. After that, it extends to building an emergency fund, without which you will never sleep well at night.

When you accomplish these goals, you are ready to start thinking about investing. But when you do, don’t obsess over returns. For a diversified investor, returns will be what they’ll be; the best you can do is accept that and don’t let your emotions get in the way. A far better use of your time and energy is to focus on what you can control: moving forward in your career, living within your means, and saving more.

Source: https://pensionpartners.com/whats-more-important-saving-or-investing/