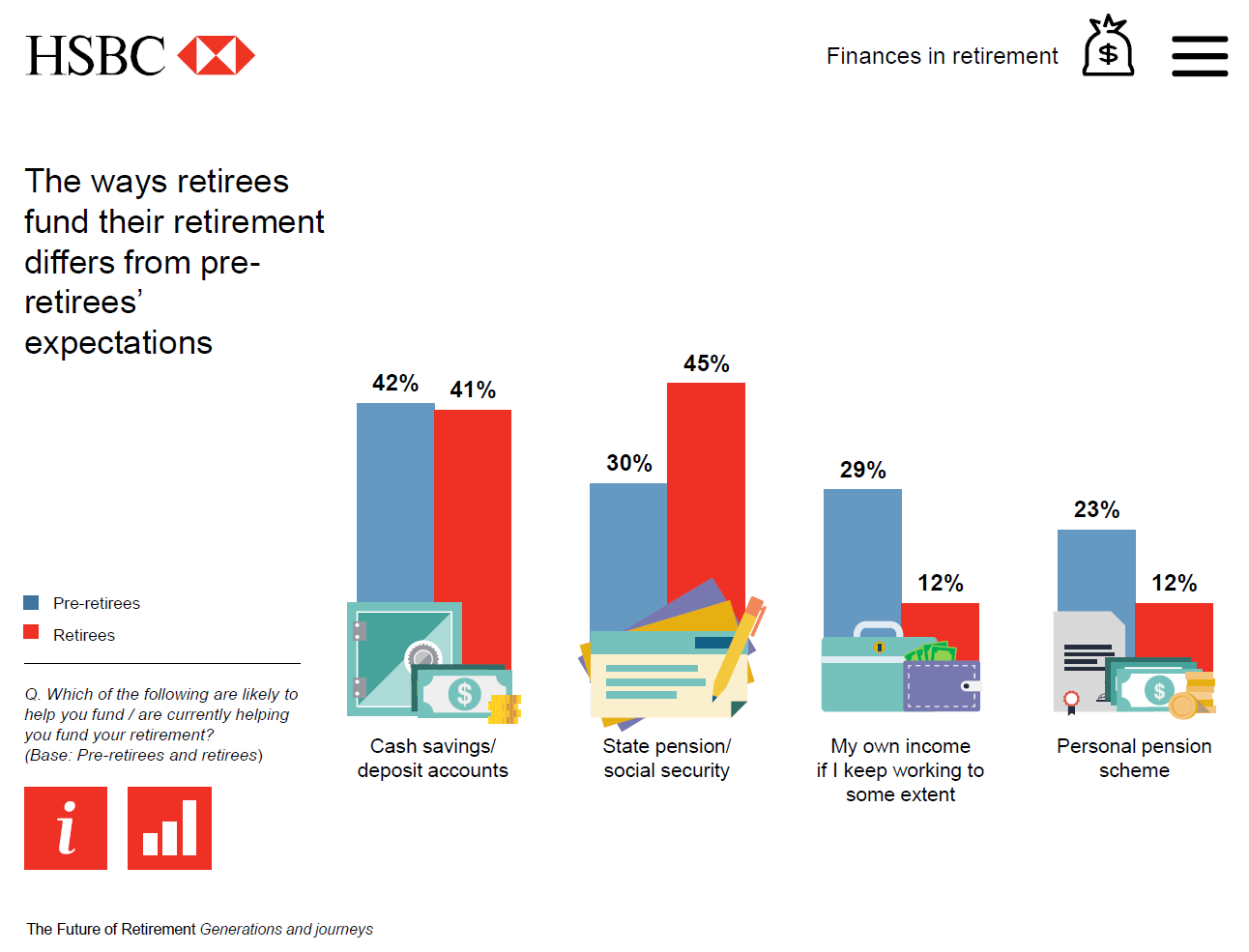

In recent research released by HSBC, entitled “The Future of Retirement – Generations and Journeys,” data is provided about pre-retirees’ expectation of where their income will come from in retirement versus where current retirees actually draw it. The chart below illustrates the results:

As you can see, there are many ways of funding retirement, and the expectations of pre-retirees differ from the reality experienced by retirees.

Nearly half (45%) of retirees use a state pension or social security to help them fund their retirement. Cash savings/deposits (41%) are also a popular funding method for retirees.

For the next generations of retirees, retirement funding methods are likely to be different.

A similar proportion of pre-retirees (42%) plan to use cash savings/ deposits to help fund their retirement as retirees (41%) do. However, fewer pre-retirees are expecting to use a state pension (30%) compared to retirees (45%).

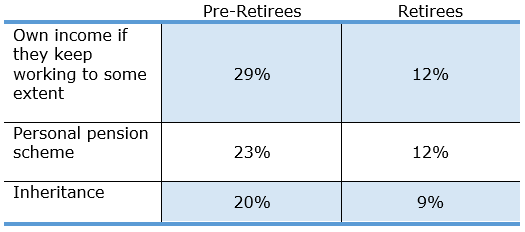

More pre-retirees than retirees are planning to use:

Despite their intentions, nearly one in five (18%) pre-retirees who say they are likely to help fund their retirement with cash savings/ deposits are yet to start saving for their retirement.