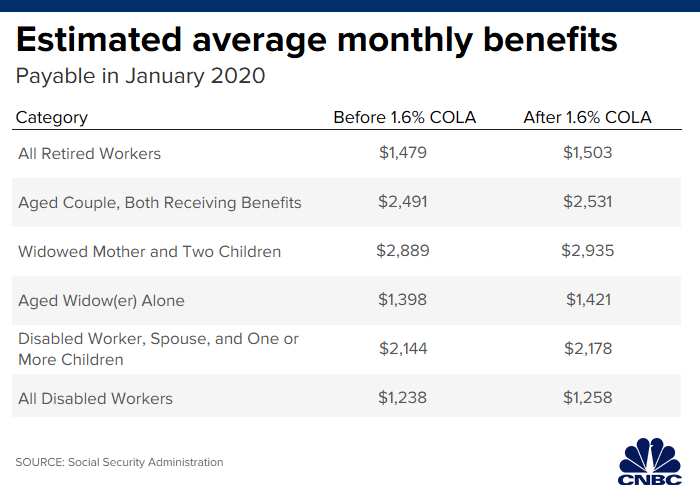

It’s official: Your Social Security checks will get a modest increase next year.

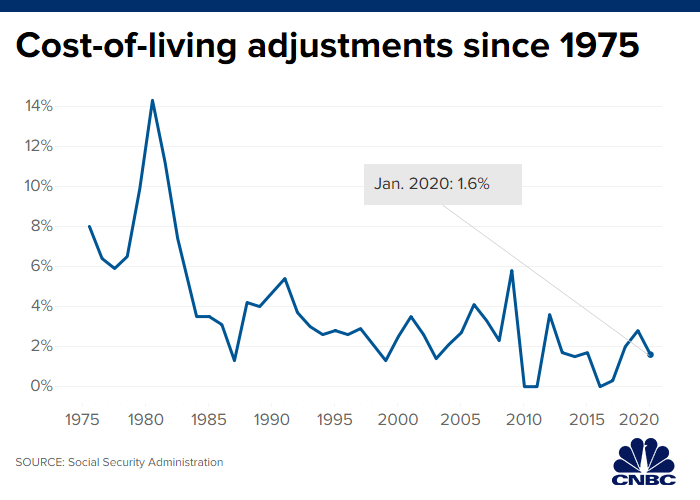

The Social Security Administration announced last Thursday that the cost-of-living adjustment for 2020 will be 1.6%.

That number is less than what retirees have received in recent years. In 2019, they got a 2.8% bump, while in 2018 the increase was 2%.

Still, it’s better than zero, which retirees saw in 2010, 2011 and 2016.

Social Security cost-of-living adjustments have averaged 1.4% in the past decade.

To calculate the change, the Social Security Administration uses the Consumer Price Index for Urban Wage Earners and Clerical Workers, CPI-W, from the Bureau of Labor Statistics.

The 2020 increase is in line with an estimate released last month by the Senior Citizens League, a nonpartisan senior group.

What About Medicare Premiums?

The next announcement for retirees to watch for is Medicare Part B premiums for next year.

Estimates from Medicare trustees peg that at $144.30, up from $135.50 in 2019.

If those estimates are correct, individuals who receive the lowest Social Security benefit amounts — $550 or less – would be protected by a rule called the hold harmless provision, according to the Senior Citizens League.

Medicare Part B premiums (which cover doctor’s visits among other things) are typically automatically deducted from Social Security benefit checks.

The hold harmless provision prevents Part B premium increases from being larger than any Social Security benefit increases. About 70% of beneficiaries are covered, according to the Senior Citizens League.

But there are some exceptions, said Mary Johnson, Social Security and Medicare policy analyst at the Senior Citizens League. For example, a low-earning spouse in a high-earning couple might not be covered, she said.

High-wage earners who do not fall under the hold harmless provision could see a small excess Medicare premium, said Joe Elsasser, founder and president of Covisum, a provider of Social Security claiming software.

When Will Social Security Benefits be Taxable?

While Social Security checks get a 1.6%boost, the tax rates on retirees’ income will stay the same.

If you earn at least $25,000 individually or $32,000 as a couple filing jointly, your Social Security benefits could be subject to taxes.

One way to plan for that is to increase your voluntary withholding with the Social Security Administration.

But a more effective way might be to increase withholdings from other sources of income. If you only have Social Security, that’s going to be tax free. It’s other income (i.e. earnings from work, IRA distributions, pension benefits, etc.) that creates the tax on Social Security benefits.

Losing Buying Power

Since 2000, Social Security benefits have lost 33% of their buying power, according to the Senior Citizens League.

That has led some advocates to call for changes to the way the COLA is calculated. Democratic proposals in Congress and by presidential candidates, specifically Sens. Elizabeth Warren, D-Mass., and Bernie Sanders, I-Vt., would use the Consumer Price Index for the Elderly, or CPI-E, which tracks seniors’ spending habits.

Another potential measure, the Chained Consumer Price Index for All Urban Consumers, which measures the average change of consumer goods and services over time, could also be used.

One important aspect about Social Security’s annual COLA is that it affects more than just beneficiaries. For example, the adjustment will affect the amount of individual wages subject to Social Security payroll taxes. Right now it’s capped at $132,900. That will go up to $137,700 in 2020.

What’s more, the cost for workers to earn a Social Security credit will go up. In 2019, you receive one credit for each $1,360 of earnings. In 2020, you that will go up to $1,410.

You now need to have at least 40 total credits to qualify for retirement benefits. (A credit is how the Social Security Administration measures your eligibility for benefits. There is a maximum of four credits per year).