Total U.S. student debt hit a record $1.31 trillion last year, the 18th consecutive year Americans’ education debt rose, according to the Federal Reserve Bank of New York.

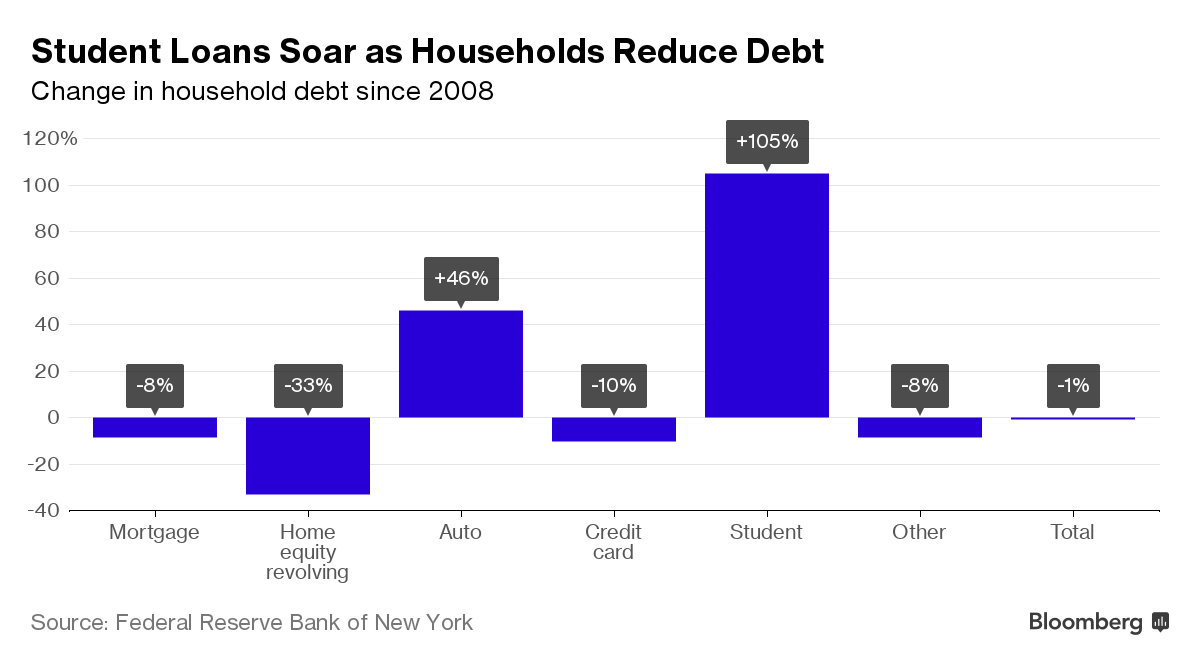

Outstanding loans taken out for higher education have doubled since 2009, data show. No other form of household debt has increased by as much since then. In fact, of the six major categories of consumer debt tracked by the New York Fed, only student loans and auto debt have increased since year-end 2008 (total auto loans are up 46 percent). Total household debt has fallen by 1 percent.

Close to one-quarter of student debtors whose bills have come due are either in default or at least 90 days late on their required monthly payments, New York Fed data suggest. Delinquencies have remained stubbornly high, despite attempts by the former Obama administration to make loan payments more affordable. The federal government owns or guarantees more than 90 percent of all student debt.

The rise in student debt worries federal regulators responsible for policing financial markets. During the Obama administration, authorities cited student debt as a risk that could slow U.S. economic growth. President Donald Trump decried student indebtedness on the campaign trail, likening it to an “anchor” that prevents Americans from advancing.

The problem could be even worse than the New York Fed’s data suggest. The report is based on a sample of household credit reports, which regulators have found are often filled with errors. The Federal Reserve Board in Washington has total student debt pegged higher, at $1.41 trillion.

The dearth of good data prompted the federal Consumer Financial Protection Bureau on Thursday to announce a proposal to collect more detailed information from the nation’s biggest student loan companies.

There was some good news in the New York Fed report. Total student debt only increased by 6.3 percent compared to last year, the smallest annual increase in data going back to 2003.