The results are in, and we now know that Donald J. Trump will be the next president of the United States. With this news comes the speculation about how Mr. Trump will govern. He’s talked a lot about changing quite a few areas that would affect financial planning – most notably in taxes and healthcare.

Sharing some excerpts below from articles at Financial-planning.com (here and here) that provide a good overview of what may lie ahead.

—————————————–

TAXES – TRUMP TAKES SOME ADVICE FROM THOREAU

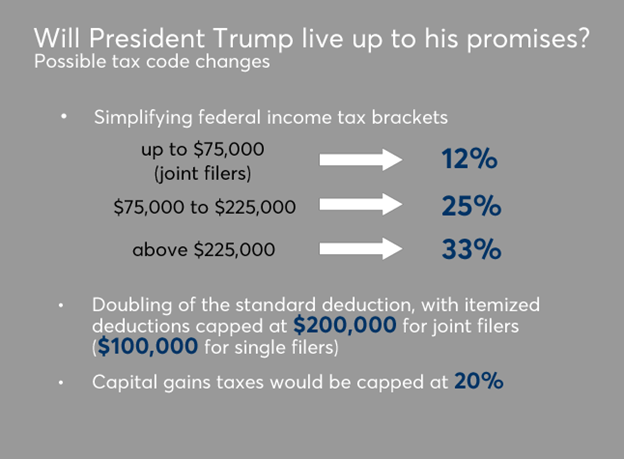

Over the course of the campaign, Trump’s ideas about taxes centered on simplifying the current code. Regarding personal income tax brackets, his proposals are below:

Furthermore, under President Trump working with a Republican Congress, federal estate and gift taxes might be eliminated. But the candidate had also proposed to eliminate the step-up in basis for estates over $10 million.

Remember that these proposals were made before anyone imagined that Americans would elect an undivided government, with the presidency, the House and Senate all under the control of one party. The next four years – indeed, the first 100 days of the new presidency – represent an opportunity to do something much more ambitious than simply tinker with our nation’s tax rules. Influential Republican leaders, including House Speaker Paul Ryan, reportedly plan to introduce a comprehensive tax overhaul. The goal would be tax simplification, but the bet here is that whatever form this takes will add thousands of pages to the current law.

HEALTHCARE – UNDOING OBAMACARE

Future President Trump and Congress will have the power to repeal the Affordable Care Act and we will likely see movement on this in the first 100 days of the new administration.

Filibuster could occur in the Senate to mitigate total repeal. There will also be significant backlash from the sudden death of health insurance for the 20 million Americans newly covered under the ACA. Because of this, we will more likely see a measured dismantling of major Affordable Care Act provisions such as the mandates that individuals purchase health insurance coverage, restructuring of premium subsidies, and stopping minimum essential benefits such as mental health coverage and pregnancy coverage.

Unfortunately, Trump has shared very little about his plans for replacement of the Affordable Care Act. So far, he has four proposals that will affect clients directly.

Back to Medical Underwriting

Guaranteed issue insurance will go away and health insurance will go back to being medically underwritten. This is great for healthy people. Insurance cost for that cohort will go down. Costs will increase significantly for people with health issues. If a person becomes unemployed and has not maintained continuous coverage, coverage will only be available through high-risk pools which historically have not provided good benefits.

If employer mandates to provide health insurance are also rescinded, it may be very difficult for people with significant health issues to get coverage.

Insurance Sold Across State Lines

Selling insurance across state lines is supposed to increase competition and reduce costs by allowing insurance companies to locate in states with the fewest regulations.

Historically, some states have provided broad protections to consumers such as mandated pregnancy coverage, minimum benefits and broad access to alternative medicine. In these states, cost of coverage is higher. If insurers from a state that provides minimum protections can sell policies in a state with broad protections, theoretically people could buy the cheaper policies with less protection.

Consumers will need to evaluate their policies carefully to make sure they have the benefits they need.

It remains to be seen whether insurance companies will move across state lines. Insurers have to negotiate rates with local hospitals and doctors. This may be hard to do in a market where an insurer doesn’t physically have a presence.

All Health Insurance Payments Tax Deductible

Health insurance payments are currently tax advantageous only if you purchase your insurance through an employer or if you are self-employed. People who are not employed and people who are employed but are not provided coverage through their employer cannot deduct their health insurance premiums. Making all health insurance premiums tax deductible will even the playing field and will allow individuals wider choices in purchasing their health insurance.

Provide Wider Transparency in Medical Billing

Healthcare organizations will be required to provide transparency in their charges. This will allow consumers to shop around for their care and find the best prices. This is fine if you are healthy and have the time. However, people who are acutely ill or with serious diseases may not have the time and energy to investigate costs.

We’ll be watching to see what unfolds from these proposals and keep it in mind as planning goes forward.