Sharing from Nasdaq.com…

Something unexpected has been the shared experience for our most recent generation of retirees. The vast majority haven’t been spending their retirement savings-leaving nest eggs mostly untouched and living on ready sources of income instead. However, future retirees may be less fortunate.

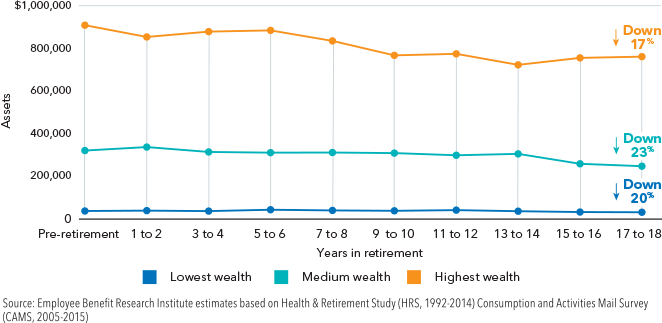

A recent paper by the BlackRock Retirement Institute (BRI) based on research in conjunction with the Employee Benefit Research Institute (EBRI) found that on average across all wealth levels, most current retirees still have 80% of their pre-retirement savings after almost two decades in retirement. Digging deeper, across all wealth levels measured, more than one third of current retirees actually grew their assets-leaving a considerable amount of money on the table.

Assets hold mostly steady over 20 years (median non-housing household assets):

Looking back: most didn’t need to or didn’t want to spend savings

Most retirees in our study appear to have coped and managed pretty well in retirement. Many could have afforded to withdraw a little and, in some cases, a lot more from their retirement accounts but chose not to, potentially leaving in some cases large amounts of hard-earned savings unspent.

Looking forward: need to spend down retirement assets may only increase

Many of the retirees captured in this research were fortunate to be able to maintain a reasonable standard of living without significantly tapping into their retirement savings principal. Future retirees may not be so lucky for several reasons:

- Pension benefits. On average, 42% of the retirees tracked in the research received income from a defined benefit (DB) pension: Few, if any, of those retiring over the next 10-20 years can expect income from a DB plan.

- Social Security. Income from Social Security is the largest component in the retirement income mix for all retirees, but pressure on Social Security finances could lead to a future drop in benefits.

- Rates of return. Over the past 35-plus years asset classes have delivered robust returns in the form of asset appreciation and interest income; few asset classes are expected to perform at the same levels into the near future.

- Savings behavior. Future retirees will need to save more and be more confident around drawing down retirement assets-or else be prepared for potentially significant belt tightening.

- Longer life span. People are living longer and will need to have their retirement assets last longer, in some cases much longer.

Shifting demographics and a more challenging market environment will only elevate the complexity and importance of helping retirees maximize the value of retirement savings. But the good news is that with improved savings behavior, steady and consistent investing, and sound guidance on retirement income, future retirees can take the steps necessary towards a comfortable standard of living.