One of the largest perks offered with 401(k) plans is the ability for employees to reduce their taxable income, meaning Uncle Sam won’t be able to collect taxes on the dollars you contribute. The deferral limit is $19,000 in 2019 for traditional and safe harbor plans, according to the IRS. And workers who are age 50 and older can contribute an additional $6,000 in catch-up contributions.

Individual retirement accounts offer similar benefits. Your total contributions to all of your traditional and Roth IRAs cannot be more than $6,000 — $7,000 if you’re age 50 or older — in 2019, according to the IRS.

Some employers provide more incentives to contribute including matching all or some of what their workers contribute. Overall, the goal is for workers to build their accounts as their salaries grow and ideally get an added boost from the economy.

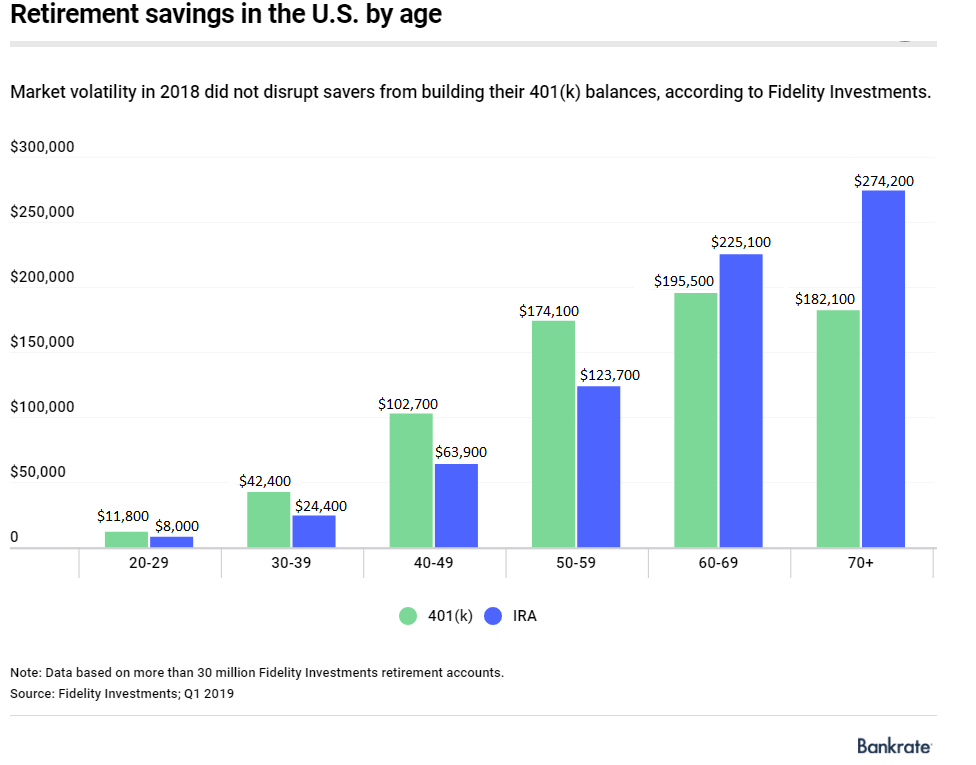

People in the sunset years of their career typically have the most saved while those who are younger are more likely to have smaller balances that will grow with time.

Here’s a breakdown of average 401(k) and IRA balances by age:

Now, compare these average balances to a recent Schwab survey, which found that on average, Americans believe they will need $1.7 million to retire – clearly there still seems to be a huge discrepancy between expectation and preparation.