Happy New Year to you! I hope everyone has a healthy start to 2017!

The start of the year is a perfect time to increase contribution rates to company sponsored retirement plans. Quite simply, a change enacted in January gives you a whole year of higher savings! Some companies nowadays try to help workers increase their contribution percentage gradually over time by allowing them to elect an annual percentage increase. If that isn’t available, an annual check-up of your contribution rate can make sure you don’t fall behind the retirement savings curve.

So if you were someone who set their contribution percentage based on what she could afford at the time you started (or hopefully at least enough to receive any company matching funds) and then forgot about it, never increasing to accommodate for higher earnings or the need to save more, now is an excellent time to review your contribution percentage and see if you can sock more away.

On a related note, I’m sharing the article below originally posted by the Motley Fool that reiterates the title above. When it comes to retirement preparedness, it’s not only what you make, but also what you save that counts.

————————————————————

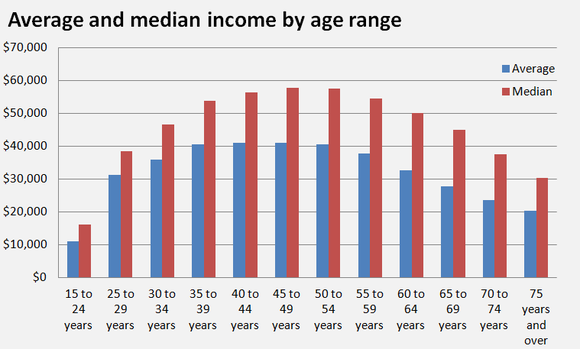

Nationwide, the average American under age 65 is earning $31,738 per year, according to the Census Bureau’s Current Population Survey. However, average income varies significantly by age, and a more useful comparison for determining your financial preparedness may be your contribution rate to savings accounts. Are you on track for financial security?

Because averages can be deceiving, it’s useful to consider average (mean) income and median income. As a quick refresher, the median is the exact midpoint of a range of data, so there’s an equal likelihood of falling above it or below it.

As the following chart illustrates, our mean and median incomes start off low, build steadily into our 40s, and then begin declining up to and throughout our retirement:

If your income is above these figures, don’t pat yourself on the back too quickly, because while the amount you earn has a big influence on retirement preparedness, an equally important figure is the percentage of income that you’re saving. After all, a high income that’s hardly saved at all won’t guarantee financial security in the future.

An individual earning $40,000 per year over a forty-year career who saves 5% of his or her income annually, or $2,000, and earns a hypothetical 6% interest rate, would end up with a nest egg valued at $310,142.98. Meanwhile, someone earning $30,000 who saves 9% of his or her income annually, or $2,700, would end up with a significantly higher $417,857.31 set aside for retirement.

Therefore, it’s most useful to focus on — rather than how your income stacks up — the percentage of your income you’re saving compared to your peers.

According to Transamerica, the average American worker is contributing 8% of income to employer-sponsored retirement plans annually. Baby boomers are socking away 10% per year, while Generation X and millennials are saving 7% of their income per year.

Boosting income can obviously have a substantial benefit on your retirement savings. However, you can still make up ground by maxing out your contribution rate to your retirement plan, if a raise or job change isn’t in the cards.

If your contribution rate is below average, then create a plan now to increase it. Even if your budget is too tight to increase your rate to double digits immediately, increasing it by 1% annually could get you on pace for success, without forcing you to make major changes to your lifestyle.