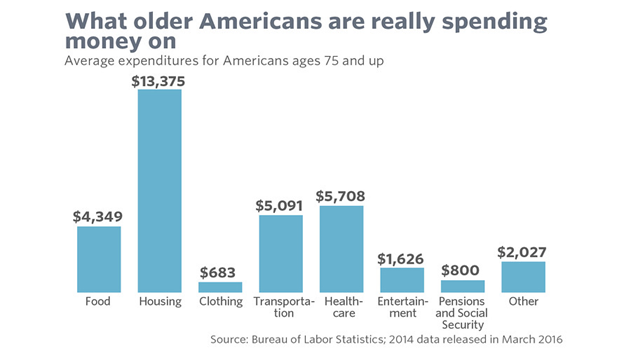

A report from the Bureau of Labor Statistics indicates that retirees in the 75-above bracket incur an average of $36,673 in expenses annually. More than half of this amount goes to housing ($13,375) and health care ($5,708), the report says.

There may be a common misconception that people will have their homes paid off by the time they retire; in fact, nearly one in five people ages 75 and up still has mortgage debt, according to government data. Still many others rent their home. Add to the cost of a roof over your head other household expenses, including utilities, insurance and maintenance, and it all adds up to a retiree’s largest expense by far.

When it comes to healthcare, Medicare is an important part of most retirees’ health care plans, although there are some things it does not cover, such as eyeglasses, hearing aids and dental care. Here is a rundown from U.S. News & World Report of the costs that retirees should expect in retirement, including premiums and deductibles (which explains why it is second only to housing as a cost in retirement):

- Most retirees pay the standard Medicare Part-B premium of $105 per month in 2016. However, some pay more, such as beneficiaries who have not yet claimed (who will pay $122 per month) or high-income retirees bringing in more than $85,000, or $170,000 for couples ($171 to $390 per month, depending on their income)

- Part-B has a $166 deductible in 2016. After that, Medicare beneficiaries typically pay 20% of the cost

- For situations that require a hospital stay, Part A has a $1,288 deductible. Patients have to pay each time they are admitted to the hospital, notes an expert, so people who need hospital services frequently can see out-of-pocket costs skyrocket

- Prescription drug coverage is $41 per month in 2016 on average, although plans are allowed to charge deductibles of up to $360

A final note about Medicare and costs: individuals can help themselves and avoid late penalties by signing up for Medicare during the seven-month initial enrollment period that begins three months before they turn 65. If they don’t sign up for Medicare during this initial enrollment period, they may be charged higher premiums for the rest of their life.