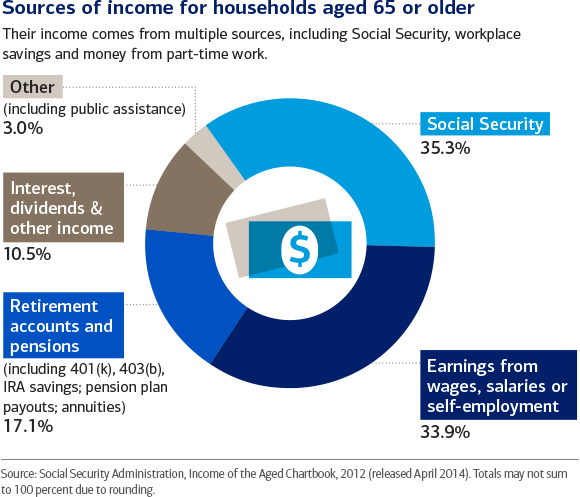

As you explore how much money you might really need in retirement, remember that the amount you decide to save and invest on your own is only one component of your future retirement income.

Most Americans will have Social Security as the backbone of their retirement savings (even if benefit payments are reduced in the future, Social Security is not likely to go away).

But what may be surprising to some is just how much a retiree paycheck comes from work! The chart above shows, more retirees today are also increasing their income by working part-time or consulting, making earnings the second major source of retirement income today.

Source: https://www.merrilledge.com/article/how-much-do-you-really-need-to-save-for-retirement