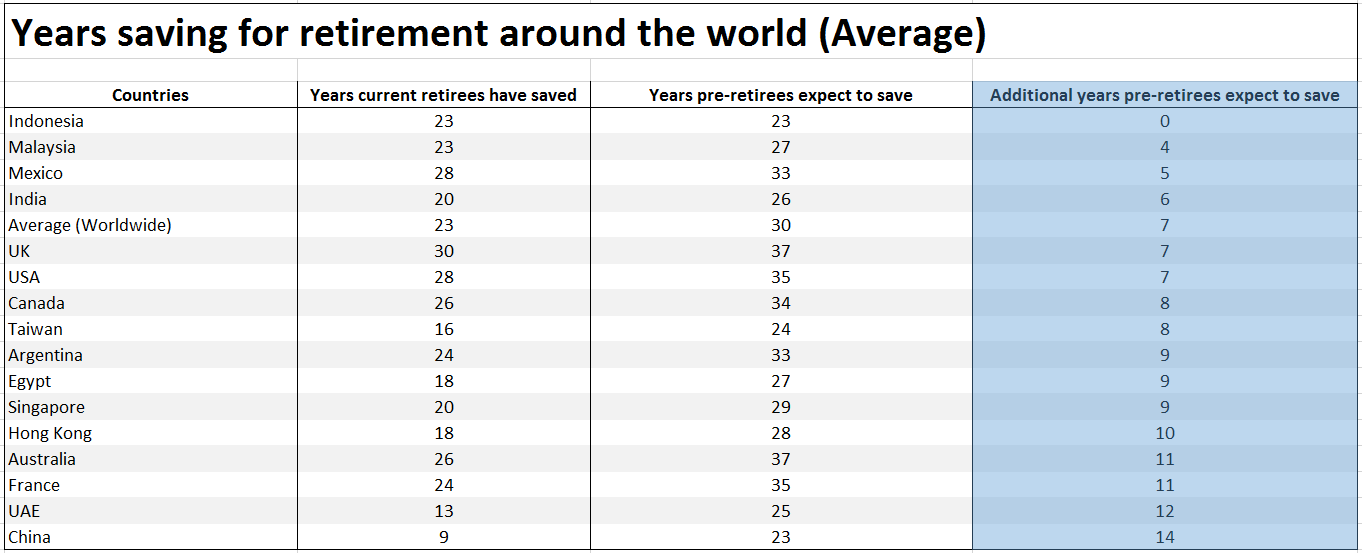

Current retirees may have worked tirelessly to ensure that their retirement is financially bulletproof, yet for today’s typical worker to achieve the same status, they’re expecting to save for an additional seven years, new HSBC research suggests.

Having interviewed over 18,200 people across 17 countries either online or face-to-face, the leading lender discovered that workers now expect to save for an average of three decades to feel financially secure for retirement — seven years more than the previous generation, on average worldwide.

China’s working community is expected to take on the biggest hurdle, with pre-retirees expecting to now save for an additional 14 years, bringing their average saving total up to 23 years, compared to the nine years that current retirees had saved for.

The United Arab Emirates, Australia, France and Hong Kong are also worse off, with each average citizen looking to save for an additional 10 years or more on top of their current average, to feel financially ready for retirement.

Meanwhile, Indonesia was the only country surveyed that doesn’t expect to save for longer than its current average, as many pre-retirees started saving earlier, but expect to retire earlier too, according to the “Generations and journeys” report.

When it comes to how workers plan to save for their future, alternative saving methods are becoming increasingly attractive compared to relying on traditional state pensions. Cash savings/deposits, downsizing or selling property, and personal pension schemes were among some of the options people are looking into to fund retirement.

While it appears the working population is becoming more financially-conscious about retirement, over a third admitted that they wish they’d started saving earlier on. Meanwhile, 24 percent confessed they hadn’t begun saving for retirement, including 12 percent of those in their 60s.

However it isn’t all that easy for workers who have started to save either. Forty two percent of those who have begun saving admitted to having either faced challenges or stopped, when it came to preparing for life after work.

While the way we save for retirement differs from person to person, HSBC stresses that it’s essential for individuals to start saving as early as possible, even if it’s a small amount.