Some food for thought for your Tuesday…

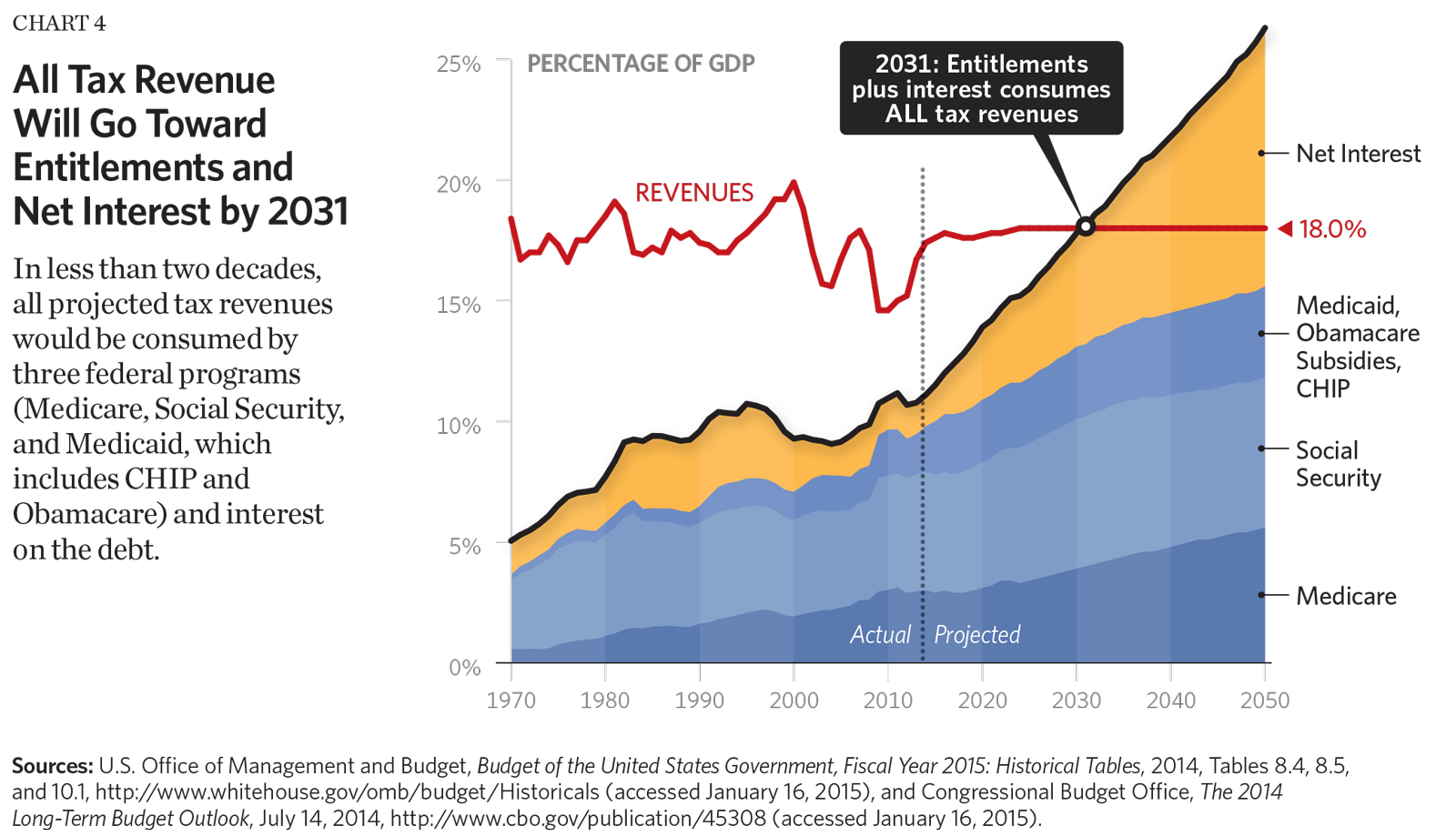

The following is a chart from the website, The Budget Book. It illustrates that by their calculations, by 2031 all projected tax revenues would only be enough to pay for 3 federal programs (Medicare, Social Security and Medicaid) and interest we owe on our national debt.

No wonder a lot of tax payers feel like this even today (add the horses Medicaid and debt interest to the cart):

So what does that mean for the future of these programs and everything else itemized in the federal budget? With only 4 areas covered, that will leave a huge shortfall for everything else. One sure thing is that the current path is not sustainable so changes are more a likelihood than a possibility. And for people planning their retirements, contingencies should be made that factor in the potential drastic changes to (or at worse case elimination of) these programs by the time they leave the workforce.