As 2015 draws to a close, it’s a good time to take stock and begin thinking about what you want to accomplish in the year ahead. The time-honored tradition of making a New Year’s resolution can be especially helpful when it comes to gaining better financial security. Consider the following from Fidelity’s 7th annual “New Year Financial Resolutions” study:

Make 2016 the year you:

- Commit to maxing out your retirement savings vehicles [$18,000, or $24,000 for those over 50, in 401(k) accounts, or $5,500, or $6,500 for those over 50, in IRAs)

- Create a monthly budget and stick to it

- Build up your emergency fund so that you have at least 3 months of essential living expenses in savings

- Start a dedicated savings plan for your house, boat, dream vacation, or any other goal that requires extra cash

- Make sure that you have an estate plan, or if you already have one that it is up to date

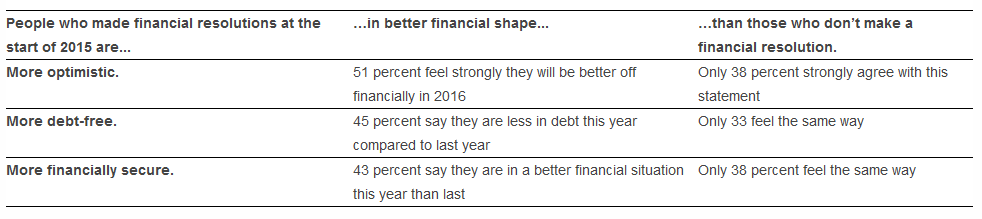

So as you are celebrating the holidays, I encourage you to take a little bit of time to think about the financial goals you want to accomplish next year. That way you can start working towards them immediately come January 1. Committing to financial goals such as saving more and paying off debt can have a tremendous impact over time, and may be why people who make resolutions on money matters tend to feel better about their financial wellness than those who don’t.