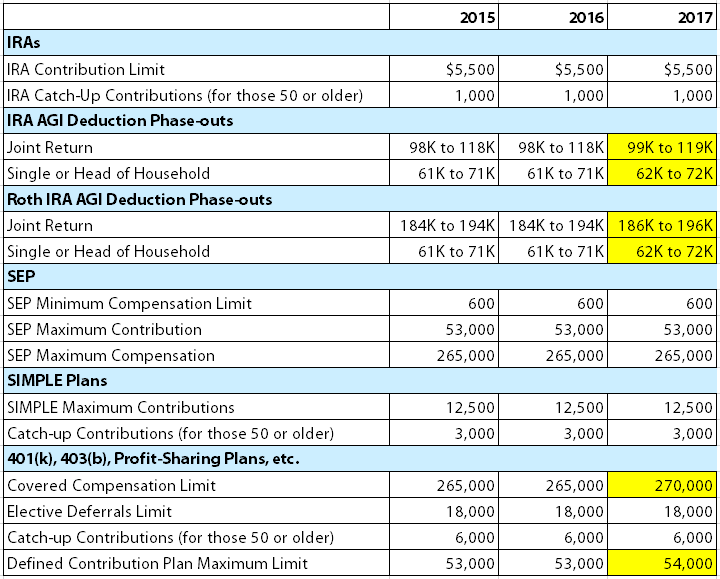

This week the IRS issued Notice 2016-62, updating the retirement plan limits for the year 2017. Like with Social Security, limits associated with retirement plans (and estate planning, for that matter) are increased based on the government inflation calculation. A very modest increase in inflation means a small increase for some limits from 2016 to 2017. See the table below for a summary and year-to-year changes highlighted in YELLOW.

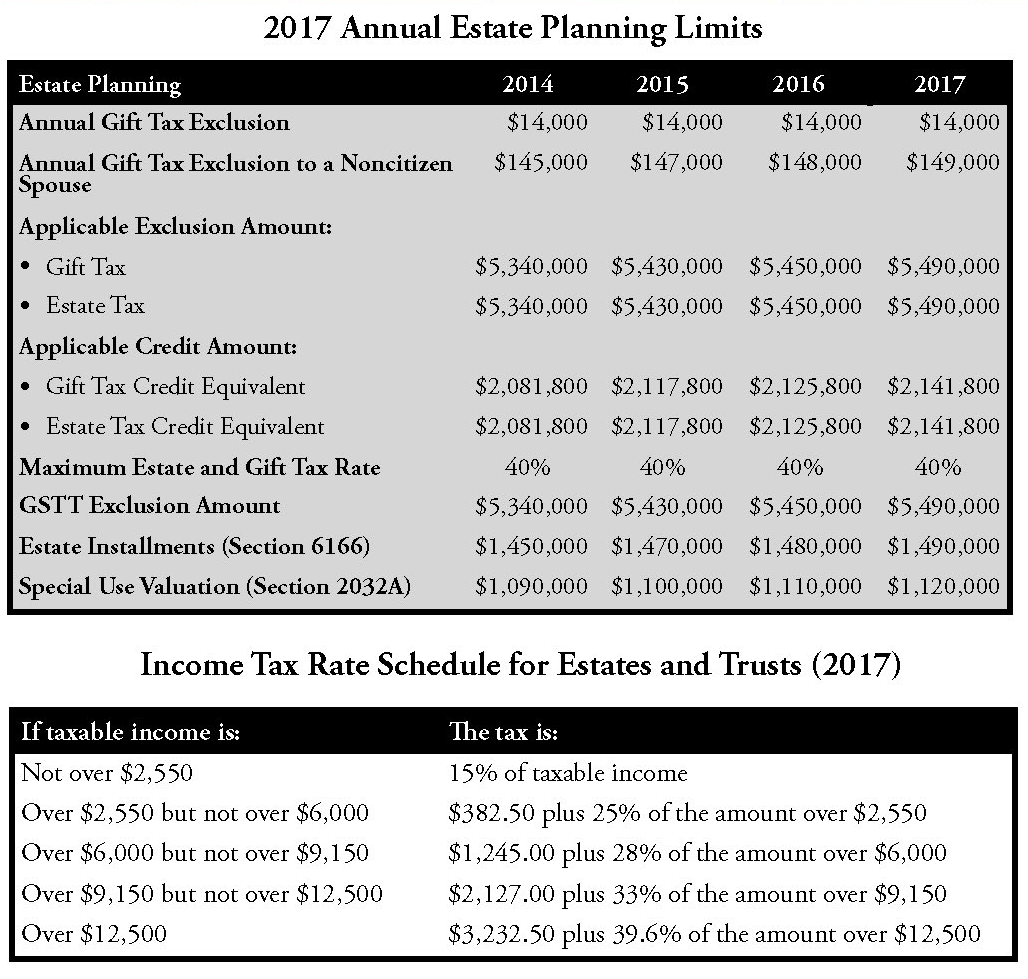

The IRS also released the estate planning indexed numbers for the year 2017. Again, most of the numbers have been modestly indexed, with the notable exception of the annual exclusion that remains at $14,000 per donor per donee. See the last column in the table below for the latest estate planning limits.