From money.com

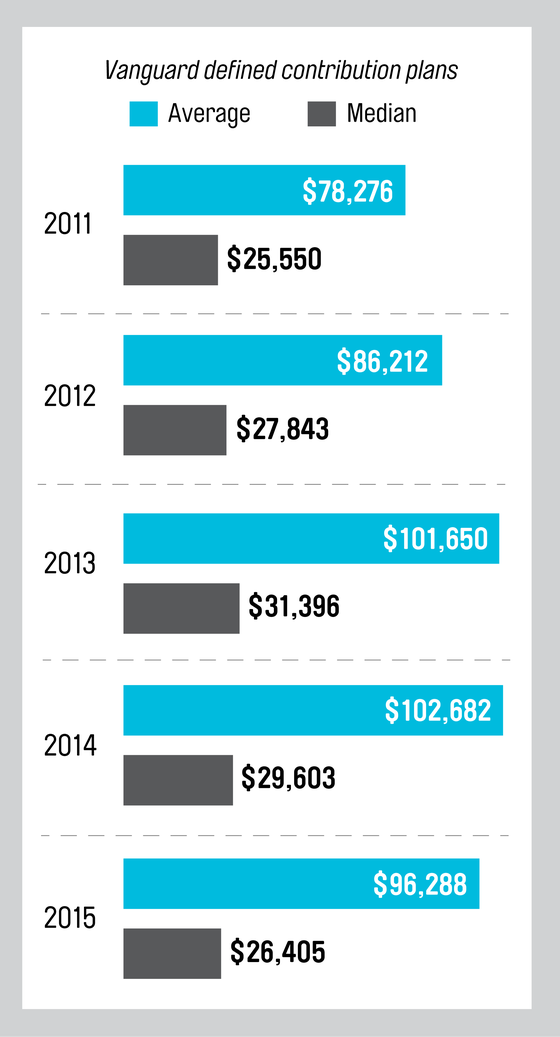

After years of steady increases, retirement savings plans hit a downdraft.

Source: Vanguard, How America Saves 2016

Source: Vanguard, How America Saves 2016

Last year the average 401(k) balance stood at $96,288, down from $102,682 in 2014, according to Vanguard. The median balance was $26,405 vs. $29,603 previously.

Overall this decline reflects major pressures holding down retirement savings. For starters, market returns have been anemic recently—the typical 401(k) saver chalked up a slightly negative return of -0.4%, although five-year total returns averaged 7.3%.

Auto-enrollment has also dampened 401(k)s balances. As more new workers are auto-enrolled into their plans, participation rates have climbed to nearly three-quarters of eligible workers vs. two-thirds in 2006. But workers tend to be enrolled at a low 3% contribution rate, and they generally to stick at that level for the long term. “As the effects of auto-enrollment kick in, there are more small balances,” says Vanguard senior research analyst Jean Young, the lead author on the report.

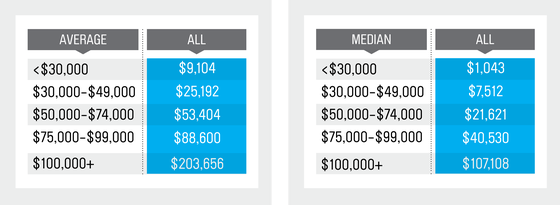

Higher-Income Workers Build the Biggest Balances

On average, it takes six-figure salaries to amass six-figure savings.

Source: Vanguard, How America Saves 2016

As you might expect, breaking down 401(k) balances by income shows a dramatic difference in retirement wealth. The average worker earning $50,000 to $74,999 held a $53,404 balance, while those earning six-figures amassed more than $200,000.

A $200,000 balance may sound like a lot. But it translates into an annual income of just $8,000, assuming a traditional 4% withdrawal rate and a 30-year retirement. That’s hardly enough for a comfortable lifestyle when you stop working. And given the forecasts of below-average market returns, many investing pros suggest using a lower withdrawal rate, perhaps 3%, to avoid running out of money.

Of course, many higher-income workers may stash savings outside their 401(k)s. And younger workers have time to build larger balances. Still, the typical 401(k) participant with more than 10 years on the job has a balance of just $187,000. And pre-retirees—those ages 55-64— have average balances of just $177,805.

The breakdowns by gender are also worrisome. Women tend to save at higher rates than men—on average, women earning $50,000 to $74,999 contribute 7.1% of pay vs just 6.6% for men. And they have an average balance of $53,404 vs. $21,621. Yet overall the typical male worker has a 401(k) balance of $115,835, compared with a $75,771 balance for female workers, Vanguard data show. Why the difference? It’s income inequality—women tend to earn less than men.

Source: http://time.com/money/4357248/retirement-401k-vanguard-balance/