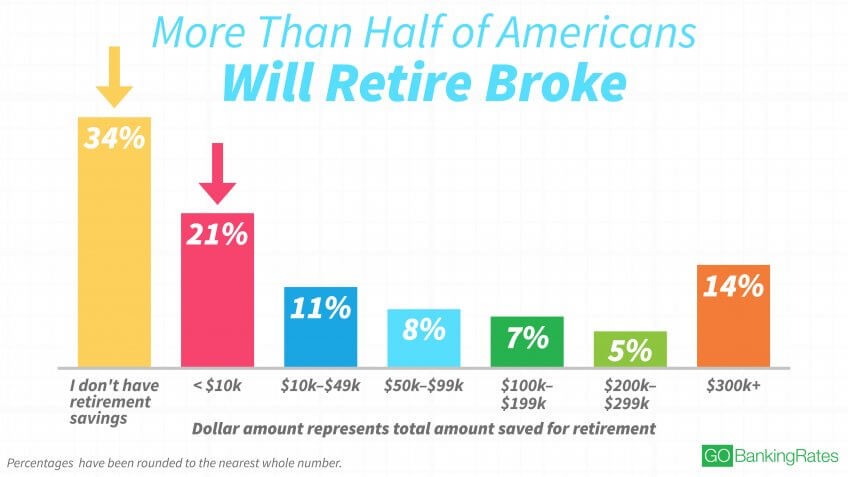

A 2017 Retirement Savings survey from GOBankingRates found that 55 percent of Americans have less than $10,000 saved for retirement. That’s hardly an improvement from their 2016 results, when 56 percent of those surveyed said they have less than $10,000 in retirement savings. What’s worse is that the bulk of those Americans with less than $10,000 set aside actually have nothing saved — which mirrors last year’s survey results.

GOBankingRates’ 2016 survey found that 33 percent of Americans have $0 saved for retirement. This year? Again, a shocking one in three (34 percent) survey respondents said they haven’t started their retirement savings.

Considering the fact that adults 65 and older spend, on average, nearly $45,000 a year, according to the Bureau of Labor Statistics, most Americans don’t have enough to cover a year’s worth of expenses in retirement — let alone a few decades’ worth. Without other sources of income, they’d quickly be broke.

Why aren’t Americans saving for retirement? There are several reasons why such a large percentage of people still don’t have anything saved. However, the biggest reason could be because they don’t have access to a workplace retirement plan. Many workers don’t have a 401k, which is an easy, systematic way to save for retirement.

This lack of access to a workplace retirement plan means workers are less likely to save for retirement on their own. What’s stopping them? Many don’t realize there are several options beyond workplace plans to be able to save for retirement, like Individual Retirement Accounts (IRAs). Clearly a better effort needs to be made to educate and make people aware of their options if we hope to improve upon the health of America’s retirement savings.

There is a glimmer of good news in the results – although the majority of Americans have less than $10,000 saved, the GOBankingRates survey did find that some people are making an effort to set aside money for the future. And they could be on track for a comfortable retirement. For example:

- More than 1 in 4 Americans have $100,000 or more saved.

- The most common balance Americans have set aside — after “less than $10,000” — is “$300,000 or more.”