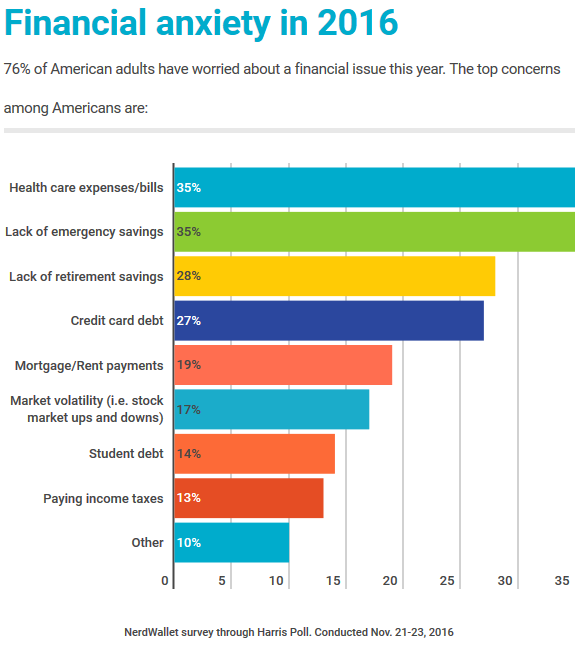

Sharing this infographic from Nerdwallet regarding American financial anxiety.

As the graphic shows, the struggle to save for retirement — and the anxiety caused by feeling behind — is a high financial concern reported by Americans in 2016. Three-quarters (76%) of Americans said they experienced at least some financial worries last year, with health care expenses, lack of an emergency fund and credit card debt also topping the list.

To turn that retirement anxiety into a higher level of confidence going forward, here are some actions to take immediately:

- Prioritize savings as a goal and then save appropriately. An emergency fund is an important savings goal, but it shouldn’t stop Americans from saving for retirement, especially if they’re offered a 401(k) or other workplace plan with matching contributions. Generally, save enough for a starter emergency fund ($500 can cover most unexpected expenses). Then shift priority to retirement plan contributions, making sure to capture any company match. Any additional saving available after that can focus back to building your emergency fund until the requisite 3-6 months of expenses has been amassed.

- Use the right retirement accounts. A savings account is not a retirement account; it is best used for short- and midterm goals and for savings that need to be liquid, like an emergency fund. For retirement, savers should prioritize a workplace plan with an employer match, then consider individual retirement plan options like a Roth or traditional IRA.

- Create a retirement plan to pinpoint retirement needs. A good retirement plan can help Americans figure out how much they should be saving on a monthly basis to meet their retirement needs. Having a concrete retirement goal in mind makes it easier to map out a path toward meeting that goal.

- Regularly increase the amount of retirement savings contributions. The ultimate goal for most people should be saving 15% of income for retirement, but that goal can be reached in a series of small steps, by increasing contribution levels on an annual basis. One way to do this is to align contribution increases with income increases from a raise or bonus.