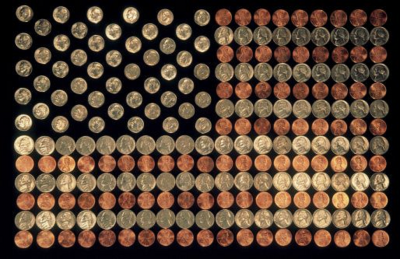

Earlier this week we celebrated the day that the United States declared its independence from Britain. One factor that played a part in the colonies’ desire to separate from Britain was financial independence.

Yahoo! article “7 Habits to Help You Reach Financial Independence,” defines financial independence as “having enough income to pay your living expenses for the rest of your life without having to work full time.” While that may seem more like a definition for how we want to live in retirement (most notably the part about not having to work full time), to me financial independence is much simpler: it’s about not being dependent on others or feeling as if we can’t break free from debt. For most people that will include working full time and building up savings so that eventually they won’t have to rely on work as their main source of income.

The ability to pay your expenses and prepare for the future is important. The habits Yahoo! recommended include:

Pay yourself first. You’ve likely heard it before but if it seems as if you are drowning in bills and debt, this can be difficult to do. However, as Yahoo! points out,” Paying yourself first encourages you to live on a smaller budget and it’s a powerful saving habit.”

Don’t compete with others. Free yourself from the need to measure up to the wealth you think others have. Some of us spend money so we won’t feel left behind…damaging our own financial stability when we don’t know exactly how others are able to afford certain things. While the article notes that working on your own financial portfolio may allow you to surpass others, getting ahead in that way isn’t the point. You want to improve your financial outlook for your own sake.

Be flexible. If you realize that you are likely to have tough times, you don’t have wait until you are on the brink of financial disaster before taking action. Adjusting spending or finding ways to earn extra income can help you turn things around a lot faster.

Although you want to be financially independent so you do not need to rely on family or overuse credit, you don’t have to go it completely alone. Partnering with a fee only financial advisor can keep you focused and help you work towards financial independence.