Passing this along from the Motley Fool, a good breakdown of Social Security Retirement benefits….

————————

By Dan Caplinger

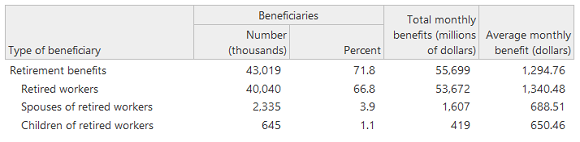

Social Security is primarily for retired workers. With almost 39 million retirees taking benefits on their own work records, this Social Security benefit makes up more than three-quarters of the total money that the SSA pays out in benefits.

The average retired worker received $1,340 in the most recently reported month, according to the SSA. Those amounts won’t rise markedly when January’s results come out, because unlike in most years, there won’t be a cost-of-living adjustment upward in benefits for Social Security in 2016.

In addition to those retiree benefits, Social Security also makes payments available to spouses and certain qualifying children of retired workers. As you can see from the numbers above, the numbers of people receiving spousal and children’s benefits are relatively small, and the dollar amounts are on average around half of what workers receive for their own account.

Specifically, the typical spouse receives just $689 in monthly spousal benefits, with about 2.34 million spouses claim benefits. Children on average get $650 per month, but the limited eligibility for children means that only 645,000 children received such payments in the most recent month for which figures are available.

How to make your Social Security payment bigger

As small as those spousal and children’s benefit figures look compared to what workers get, they’re consistent with how the Social Security methodology works. The SSA determines the amount that spouses and children get by using the half of the worker’s full retirement amount as a starting baseline. Payments to spouses and children can then be limited by family maximums that impose caps on the total monthly benefits that a family receives. With the maximum set between 150% and 180% of the worker’s full retirement benefit, large families can see substantial reductions in per-person benefits, pulling down the average.

For workers, two main factors affect their benefits: how much they earn and when they start taking their monthly benefits. Those with careers of 35 years or longer do the best at maximizing their benefits, because the SSA looks at the 35 top-earning years after adjusting for inflation.

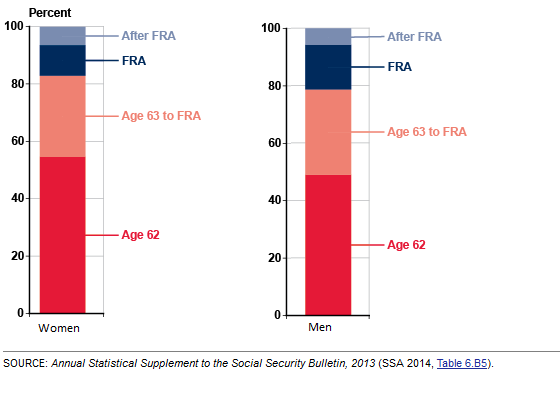

When you claim Social Security plays the biggest difference in what you get. More than half of retirees take Social Security benefits right at age 62, when they first become eligible, according to an SSA study conducted in 2014. Only about 20% waited at least until full retirement age of 66, with only a small portion of those waiting beyond 66.

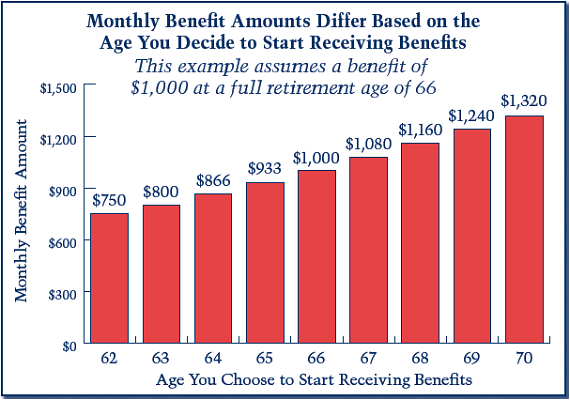

Yet waiting can increase your benefits dramatically, even though you give up the early payments you’d get by claiming at 62. As you can see below, someone with a $1,000 benefit at full retirement age gets only $750 by claiming at age 62, but can get as much as $1,320 by waiting until age 70.

Similarly, spouses who claim spousal benefits before full retirement age can end up getting less in benefits. Unfortunately, spouses aren’t entitled to delayed retirement credits beyond full retirement age, so there’s no benefit from waiting beyond age 66 to take spousal benefits.

Everyone wants to get as much Social Security as they can. By knowing the rules involved in calculating benefits, you can do your best to make sure you end up above average.