Everyone’s had the thought after a long, grueling, stressful day on the job – if only I didn’t have to go back. How much would it take to make that thought a reality?

The recent FIRE movement (Financially Independent, Retire Early) has gotten more and more younger people crunching the numbers. The article below, originally posted at Business Insider, presents possible scenarios of how much someone would need saved and invested based on their retirement age goal. My take – it just reinforces the fact that if retirement at any age is your goal, it takes planning, discipline to save and attention to investing to get there – the amounts aren’t small…

——————————————–

Most Americans have been in the working world for at least a decade by the time they reach their mid-30s. For some people, that’s enough.

With an early retirement craze taking hold in the US, you’d probably be in the minority if you haven’t wondered, “How much money do I need to quit my job and never work again?” On a quest to crunch the numbers, we consulted Brian Fry, a certified financial planner and the founder of Safe Landing Financial.

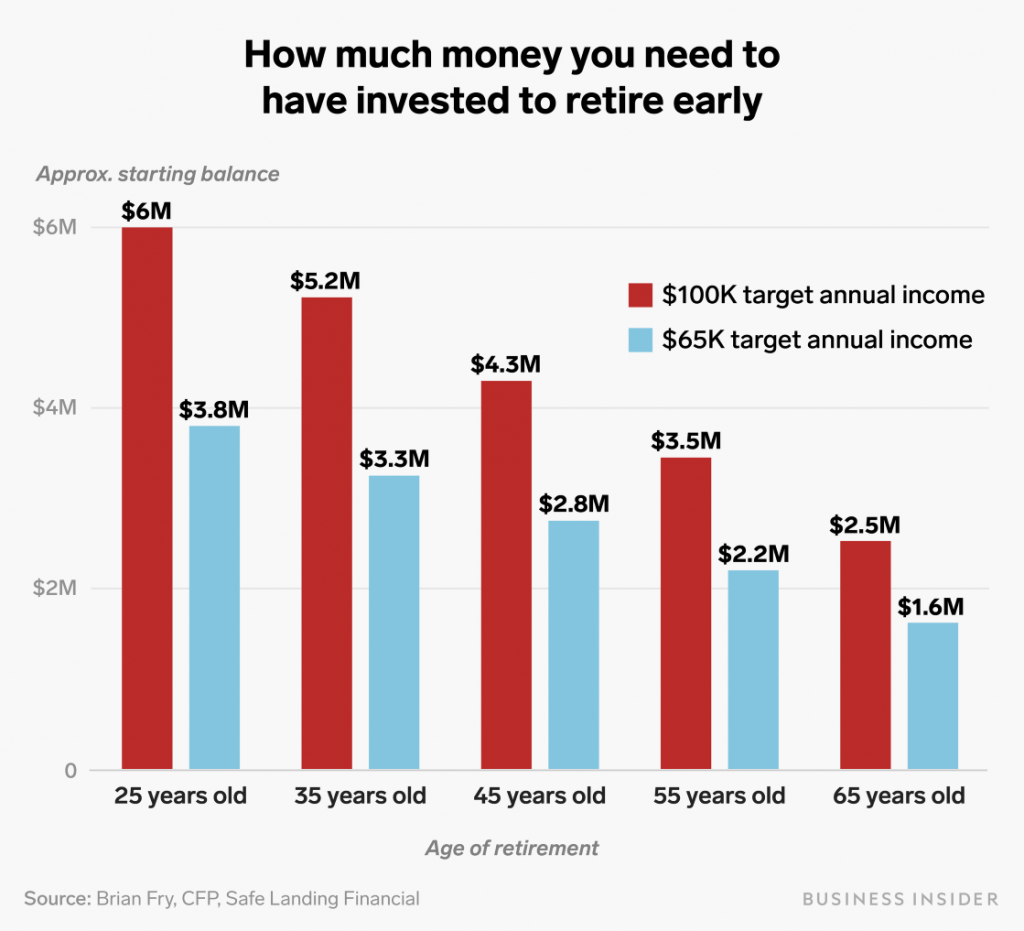

Fry used a Monte Carlo simulation to estimate the starting balance someone would need in a taxable investment account the day they leave work to live on either $100,000 a year or $65,000 a year in dividends (fixed income from bond investments) and capital gains (income from equity investments), after paying taxes, until age 90.

To run the simulation for a hypothetical retiree, Fry had to make assumptions about the retiree’s investments and tax treatments. You can find the full list assumptions accompanying the graphic below, but in short, he used JPMorgan long-term return estimates used for investments, a conservative 3% inflation estimate, assumed no state or local taxes, and did not factor in Social Security.

In addition, the investments are assumed to be held in a taxable investment account, not a retirement account like an IRA or 401(k), since you can’t withdraw money from those accounts without penalty before age 59 and a half.

According to Fry’s calculations, an investor who leaves work at age 35 would need at least $5,225,000 in a taxable investment account on the day they retire in order to have an annual post-tax income of $100,000.

If the investor reduces the target annual income to $65,000, he would need about $2 million less — or $3,250,000 — invested on the day they retire.

Fry recommends investing 80% of the lump sum in stocks and 20% in bonds, which is considered an “aggressive” asset allocation, because of the age of the investor. However, he notes, it’s important that retirees update their financial plans yearly or whenever they experience a significant life change.

“Investors tend to be their own worst enemy when experiencing investment losses,” Fry said. “If you don’t have the time, interest, discipline, and expertise, it’s better to work with a fee-only certified financial planner that can tailor your investments to track to your financial plan.”

© Alyssa Powell/Business Insider

Fry used a Monte Carlo simulation to estimate the starting balance someone would need in an investment account the day they leave work to live on either $100,000 a year or $65,000 a year in dividends (fixed income from bond investments) and capital gains (income from equity investments), after paying taxes.

The following assumptions were used in the simulation:

Investments

- All investments are in a taxable account

- Used $8,333/month for $100,000 target annual income and $5,417/month for $65,000 target annual income

- JPMorgan long-term return estimates used for investments, 3% inflation used for conservative amount

- Assumed younger investors can take on more risk than older investors

- 5% annual portfolio turnover

- $0 capital loss carry over

- No asset-under-management fees included

- Lump-sum is invested at start of simulation as cash with no built-in gains

Taxes

- No state or local/city tax factored in

- Standard deduction taken for a single filer

- No Social Security payments factored in for older investors

- Dividends – 85% are qualified dividends, 15% are non-qualified dividends

- Capital gains – 90% long-term capital gains, 10% short-term capital gains

- Tax law – TCJA sunset 2025: reflects all updated provisions related to TCJA, including the sun-setting of most individual income tax provisions in 2025

Fry notes that the Monte Carlo simulation has two clear limitations: The outputs are only as good as the inputs and it does not factor in the behavioral aspects of finance, or how investors react to swings in the markets.

It’s worth noting that many early retirees, especially those who quit corporate life in their 20s or 30s, continue to earn income after leaving their 9-to-5.

In fact, some who earn passive income through real estate investing, blogging, or some other monetizable hobby, consider themselves financially independent rather than retired, meaning they don’t need to earn a steady paycheck to afford their lifestyle.

Fry’s simulation also did not factor in potential Social Security income. Americans born in 1960 or later – age 59 or younger in 2019 – can retire with full Social Security benefits at age 67, so long as they worked at least 10 years.

The amount of a person’s Social Security benefit is equal to an average of monthly wages for their 35 highest-earning years, adjusted for inflation. The maximum monthly benefit for someone who retires at the current full retirement age of 66 is $2,861. The future of Social Security is uncertain, however, and some financial planners recommend their clients implement a saving and investing strategy to afford retirement without it.