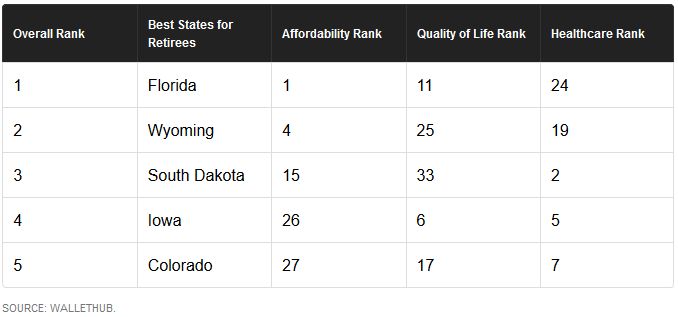

Three out of five retirees relocate after leaving the workforce, but that’s not the whole story. A Bankrate survey found that only 20% of people ages 65 and older are open to the idea, even if the cost of living is lower elsewhere. That said, a move might be worth it. WalletHub’s recent analysis of the best places to retire in 2017 weighed factors like the cost of living, taxes, and in-home health services. This may not surprise you, but Florida came out on top.

What makes a state “retirement-friendly”?

Affordability is a big factor in retirement-friendliness, and WalletHub used it as the highest-weighted category in its methodology. Overall cost of living is important, as is tax friendliness, as well as the costs of services that are important to retirees, like in-home health services.

In addition, there are quality-of-life issues to consider. After all, one of the biggest complaints from retirees is that they get bored often. So, it’s important to have things to do. Look for places that employ a lot of senior citizens in part-time jobs, as well as nearby theaters, golf courses, and museums. Of course, a low crime rate, nice weather, and good air and water quality are also important quality-of-life factors.

Finally, access to quality healthcare is a major concern for retirees who plan to relocate, so the rankings consider things like the number of physicians, dentists, and nurses per capita. It’s also a good sign if a large portion of the senior population of an area is physically active and in good health.

Whether you are firmly rooted or crave life on a faraway beach, it’s a good idea to weigh a variety of options. Don’t forget to also consider personal factors that are important to you, such as proximity to friends and family, or even the financial implications of selling a home and having to find another.

Bottom line, if you are inclined to move consider how overall state rankings compare to the most important issues for you — healthcare, for example — to find the best location for your budget and quality of life.