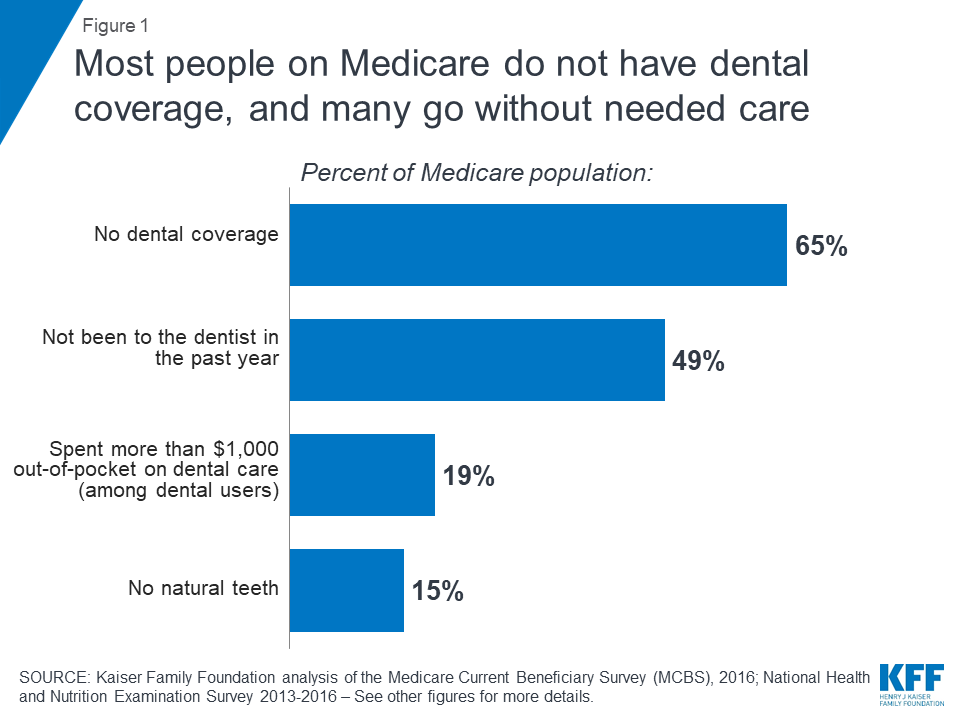

Retirees often labor under a misconception that Medicare is all they will need to take care of their health in retirement. Which is why it may come as a surprise that Medicare does not cover basic dental expenses we are used to receiving during our working years. According to a data from the Kaiser Family Foundation, nearly 7 out of 10 Medicare beneficiaries have no dental coverage at all, and half go without seeing a dentist.

The federal retiree healthcare program doesn’t pay for cleanings, fillings, crowns or dentures — all of which are services seniors are likely to need. Those who do have dental care coverage have obtained it through private Medicare Advantage plans, Medicaid and other private plans, including workplace retiree coverage and individually purchased dental insurance, Kaiser found.

The federal retiree healthcare program doesn’t pay for cleanings, fillings, crowns or dentures — all of which are services seniors are likely to need. Those who do have dental care coverage have obtained it through private Medicare Advantage plans, Medicaid and other private plans, including workplace retiree coverage and individually purchased dental insurance, Kaiser found.

Why does this matter? Dental expenses can eat away a considerable amount of retirees’ savings, with Medicare beneficiaries who went to the dentist in 2016 shelling out an average of $922 in out-of-pocket costs, according to Kaiser. Moreover, while twice-yearly cleanings tend to be fairly predictable in terms of cost (and inexpensive in the grand scheme of things), specialty dental work tends to hit patients in their pocketbooks. For instance, the cost of getting a ceramic or porcelain crown over metal can run up to $2,000 for patients who see out-of-network dentists or who have no insurance, according to FAIR Health.

Dental insurance can help lighten the load of costly procedures, but it doesn’t prevent patients from shelling out large sums. Kaiser gave the example of a 72-year-old patient who received treatment for tooth decay, three fillings and two crowns. This same patient received additional periodontal maintenance six months later.

Without insurance, he’d be shelling out an estimated $4,300 that year, Kaiser found. However, even with dental coverage via Medicare Advantage, this same patient would be on the hook for up to $3,300! That’s because insured patients often are still on the hook for deductibles and coinsurance — in which the client is responsible for a percentage of costs — and annual caps on what the plan pays.

Given the potential for large out-of-pocket spending to maintain dental health, retirees need to become empowered consumers to get the most out of their dental care. Here’s where to begin:

Understand your coverage if you have it: Whether it’s offered to you through a retiree health plan or as an add-on to your Medicare Advantage plan, get a solid understanding of your deductibles, applicable co-payments and coinsurance.

Know whether your dentist will take your plan: Your insurance won’t help you much if you’re paying more because your provider is out-of-network.

Build up your emergency fund: Nobody plans for tooth decay. Consider that surprise implant or crown to be an emergency expense, and save accordingly.

If you have a health savings account, you can’t fund it if you’re on Medicare. However, you can tap it to pay for dental and other qualified medical costs on a tax-free basis.

Get second opinions: Some dentists are more aggressive than others. If someone is recommending really expensive work, get a second opinion.

Dental expenses can eat away a considerable amount of retirees’ savings, with Medicare beneficiaries who went to the dentist in 2016 shelling out an average of $922 in out-of-pocket costs, according to Kaiser. While twice-yearly cleanings tend to be fairly predictable in terms of cost (and inexpensive in the grand scheme of things), specialty dental work tends to hit patients in their pocketbooks.

For instance, the cost of getting a ceramic or porcelain crown over metal can run up to $2,000 for patients who see out-of-network dentists or who have no insurance, according to FAIR Health.

Insurance shortfalls

Dental insurance can help lighten the load of costly procedures, but it doesn’t prevent patients from shelling out large sums.

Kaiser gave the example of a 72-year-old patient who received treatment for tooth decay, three fillings and two crowns. This same patient received additional periodontal maintenance six months later.

Without insurance, he’d be shelling out an estimated $4,300 that year, Kaiser found.

However, even with dental coverage via Medicare Advantage, this same patient would be on the hook for up to $3,300.

That’s because insured patients often are still on the hook for deductibles and coinsurance — in which the client is responsible for a percentage of costs — and annual caps on what the plan pays.

Knowledge is power

Retirees need to become empowered consumers to get the most out of their dental care. Here’s where to begin:

Understand your coverage: Whether it’s offered to you through a retiree health plan or as an add-on to your Medicare Advantage plan, get a solid understanding of your deductibles, applicable copayments and coinsurance.

Know whether your dentist will take your plan: Your insurance won’t help you much if you’re paying more because your provider is out-of-network.

Build up your emergency fund: Nobody plans for tooth decay. Consider that surprise implant or crown to be an emergency expense, and save accordingly.

If you have a health savings account, you can’t fund it if you’re on Medicare. However, you can tap it to pay for dental and other qualified medical costs on a tax-free basis.

Get second opinions: Some dentists are more aggressive than others. If someone is recommending really expensive work, get a second opinion.