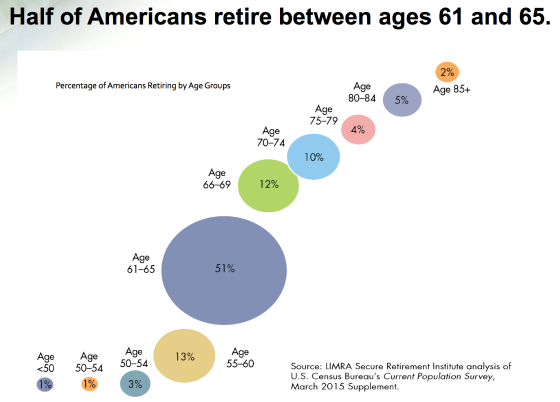

Despite a reported lack of retirement savings and less certainty when it comes guaranteed income (whether from Social Security or pension benefits) to support them in retirement, data still shows that more than two-thirds of Americans are out of the full-time workforce by age 66.

About half call it quits between ages 61 and 65 while 18% retire even earlier, according to the data shown here from LIMRA Secure Retirement Institute. By age 75, 89% of Americans have left the labor force, LIMRA says.

Here are a few other retirement statistics from the LIMRA analysis of worthwhile note:

- Along with stopping work early, most Americans begin collecting Social Security before their full retirement age (which is 66 for many and rises to 67 for those born after 1960), though the percentage of those claiming early is declining; 57% of men and 64% of women took the benefit early, according to 2014 statistics

- Half of leading-edge baby boomers, those ages 61 to 69, have fully retired and about 15% of the U.S. population is now finished with work. Among this group, the presence of a traditional pension or retirement plan is often what separates those considered income-rich from those who are not

- Top of Form

- Bottom of Form

- Retired Americans receive $1.3 trillion in income. The vast majority of this income comes from two sources: Social Security (42%) and traditional pension and retirement plans (30%). Traditional pensions remain fairly common for those over 75 but are virtually nonexistent for those under 34

- Some 41% of retirees have annual income less than $25,000, and of those, only 21% receive income from a pension or retirement plan. Meanwhile, of retirees with income over $50,000 a year, about 80% draw from a pension or retirement plan

To get a picture of how severe the retirement income crisis is—and why more Americans should consider working longer and delaying Social Security—LIMRA looked at total savings: U.S. households own $31 trillion of investable assets, which is an average of $253,200 per household; however most of that is owned by the wealthy – the median holding is just $17,500 and three in four American households have saved less than $100,000