The era of working for a single employer for the length of your career—40-plus years and receiving a pension—is a distant memory. On average, an American worker holds more than eight jobs over the course of his or her career. As a result, many retirement savers may have accumulated a variety of retirement accounts, including IRAs, and employer-sponsored accounts, such as 401(k) or 403(b), 457 or TSP plans over the course of their careers.

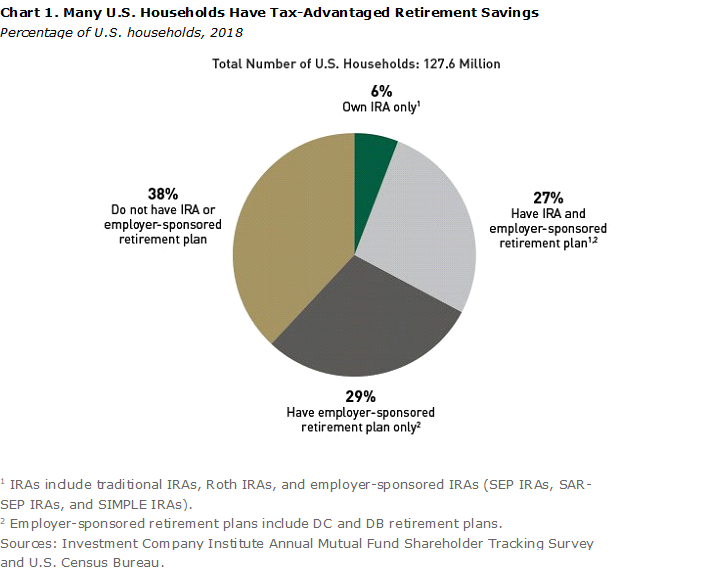

In 2018, about one-third of U.S. households owned IRAs, according to the Investment Company Institute (ICI). Moreover, eight in 10 of those IRA owning households also had employer-sponsored retirement plan assets or had defined-benefit plan coverage (i.e., pensions).

Owning multiple retirement accounts can serve a purpose. But it’s more likely that workers have accumulated accounts due to inertia. The end result is individuals have more accounts to monitor, which can be overwhelming. Instead, individuals may want to consider consolidating their retirement accounts. For example, consider rolling a 401(k) or similar plan (403(b), TSP or governmental 457(b)) from a former employer’s plan to an IRA, so that all retirement assets are located in a single location. Morever, if an individual owns multiple IRAs, he or she may want to consider transferring funds into a single IRA. Notably, traditional and Roth IRA must remain separate.

Tip: Only one 60-day IRA-to-IRA rollover is allowed per year (every 365 days). To consolidate IRAs, move the funds via a direct “trustee to trustee” transfer. The “one rollover per year” rule does not apply to 401(k)-to-IRA rollovers.

The two most common reasons for individuals rolling retirement plan assets into traditional IRAs are not wanting to leave assets behind at the former employer and wanting to preserve the tax treatment of the savings (26% and 17% of traditional IRA–owning households with rollovers, respectively), according to the ICI. Another 14% of traditional IRA–owning households with rollovers said that their primary reason for rolling over was to consolidate assets, says the ICI.

Why Consolidate?

The most immediate benefit of consolidating your retirement accounts into a single IRA is that all your assets are now in one account, which offers advantages that include:

Diversification—it’s easier to manage a portfolio that has been consolidated. Investors typically choose an investment approach that reflects their goals, time horizon, risk tolerance, and then allocate their assets to the investments deemed appropriate for their risk profile. A key component of meeting you goals is that your portfolio be reviewed and rebalanced as needed. Therefore, consolidation offers a streamlined approach to assembling and managing a single portfolio.

Investment Choices— IRAs provide a more diverse variety of professionally managed investment options than 401(k) plans. Virtually any type of investment (mutual funds, stocks, bonds, real estate, alternatives, etc.) can be held in an IRA, whereas investment options in your 401(k) are more limited.

Cost management— owning multiple accounts across providers means different fee structures, thus making it more difficult to determine true overall costs. It’s generally easier for investors to determine the true cost of their investments, as well as the amount their paying in administrative and other associated fees, when they have fewer accounts. Studies show that the disparity in fees and charges among funds can be considerable and have a significant impact on the overall returns of a fund.

Paperwork—Consolidation in the long run equals less paperwork. For example, having more than one account translates to multiple statements, tax forms, and other required disclosures. More importantly, any life changes—marriage, divorce, death, moving, etc.—requires updating multiple accounts.

Beneficiary planning—technically, this is paperwork, but it warrants a separate mention. Although beneficiary planning is (in my opinion) the most important administrative function there is, it is commonly overlooked. Whoever is named beneficiary (on your beneficiary form) will inherit your IRA or 401(k). Moreover, a separate beneficiary designation is required for each and every retirement account owned. That can be tedious, but more to the point, it increases the likelihood that something may fall through the cracks, resulting in unintended consequences.

You may have filled out a beneficiary form many moons ago and haven’t looked at it since. Find it—now! Check it—now! Does it still reflect your intent as to who will inherit your retirement assets? Many times, things change over the years. There are divorces, marriages, and births of children and grandchildren. Your beneficiary form should be updated to reflect all of these changes.

Required minimum distributions (RMDs)—generally, retirees must start taking required minimum distributions from their IRA (excluding Roth) in the year they reach 70½. Notably, investors with multiple accounts must calculate their RMD on each (separate) IRA owned, although investors may subsequently withdraw the aggregated amount from any one or more of their accounts. There is a hefty 50% penalty tax for taking less than the annual required amount, regardless of whether it was an oversight. Consolidation simplifies the process of taking minimum distributions because there is only one account to distribute funds.

Escheatment—The IRS has now made it clear that escheatment (a state government’s ability to claim abandoned property) may result in a taxable distribution. If an individual owns multiple IRAs and/or an old employer plan where you are no longer participating and there are no transactions taking place within the account, the IRA is open to escheatment. In other words, watch out for inactivity. Instead, individuals should be proactive. Review their retirement accounts regularly.

For example, investors should make sure they are receiving statements. It is generally a good idea to consolidate “old” accounts to make this process easier to manage. An individual may need to make a contribution or take a distribution, even if it is a very small one, to maintain an “active” account status.

Ultimately, by combining multiple tax-advantaged accounts, retirement savers can get a clearer picture of where they stand in meeting their retirement goals.