Contrary to what you may think, this article is not about the pros and cons of leaving your cable company in favor of a la carte streaming services. Instead it deals with a more serious cord in need of cutting when it comes to your financial security: supporting your adult children.

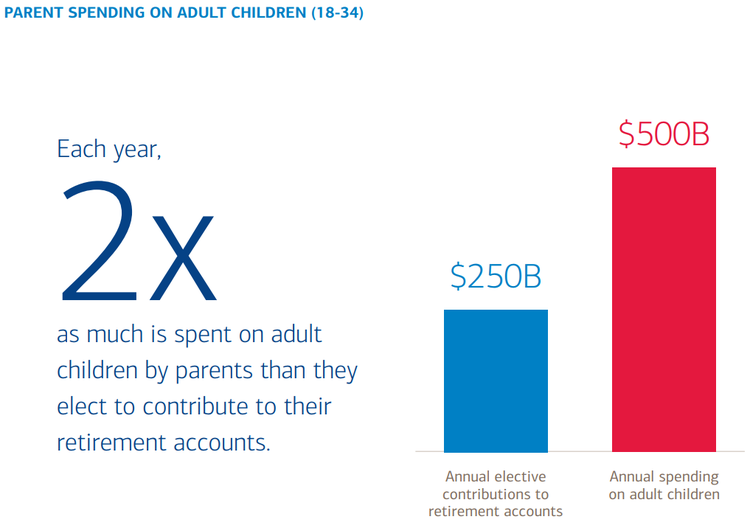

A recent report from Merrill Lynch and Age Wave found that parents are spending a combined $500 billion on their grown kids (ages 18 to 35) — double what they’re putting towards their own retirement.

Source: The Financial Journey of Modern Parenting: Joy, Complexity and Sacrifice, Merril Lynch and Age Wave 2018

According to the study, 79 percent of parents are helping their adult children in some financial way — whether it’s for their weddings, their cell phone bills or groceries.

You may be thinking, a little money here and there for groceries and cell phones seems a trifle in the long-term, but consider that more and more older Americans are compromising their retirement in order to help their children or grandchildren buy homes. A good 20% of homeowners received a gift or loan from a friend or family member to make that purchase, according to financial services firm Legal & General. And parents account for 72% of those windfalls.

All told, parents give their children or grandchildren an average of $39,000 to buy a home, and usually, that money is given in the form of a gift or an interest-free loan. The problem, of course, is that in helping younger generations, a large number of older Americans risk coming up short in retirement, and all in the spirit of generosity.

It’s certainly noble to want to help your children or grandchildren buy homes of their own, especially since it’s harder to buy today than it was in years past. But if you sell your nest egg short in an attempt to make their financial lives easier, you’ll only end up hurting everyone involved.

Imagine you give a child a $39,000 check toward a down payment when you’re 57 years old, and your intent is to retire 10 years later. If you were to invest that money at a 7% average annual return, which is reasonable for a stock-heavy portfolio, you could grow that sum into almost $77,000. And frankly, that’s a lot of retirement income to give up.

The trend of helping younger generations buy homes has, in fact, impacted many older Americans already. More than 1 in 7 say that they’ve had to adjust to a lower standard of living as a result of giving or lending money. Furthermore, 14% feel less secure about their future because they helped family members buy a home, and 7% expect to postpone retirement for the same reason.

Cutting the money cord can be difficult — especially if, as a parent, you’re watching your kid struggle with debt (as the majority of millennials do) — but if you’re risking your own financial security, it’s crucial to close (or at least radically reduce) parental funding.