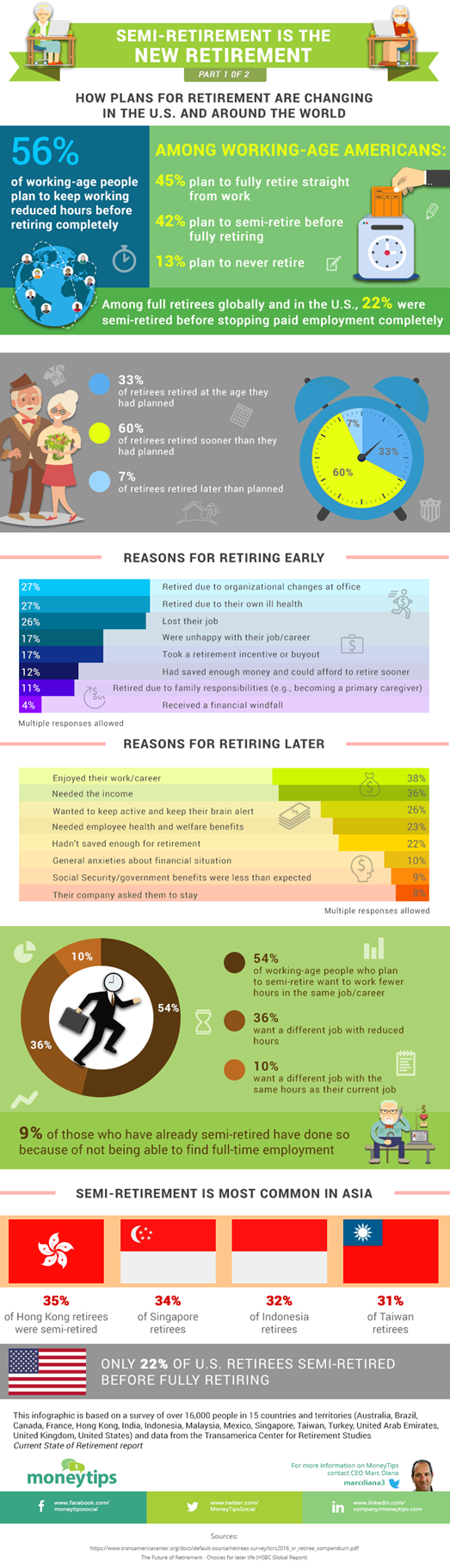

Sharing the infographic below that details a telling statistic – in the U.S. and abroad, the definition of retirement seems to be shifting. No longer does the majority think that retirement is a full stoppage of work at whatever your target age may be. Rather 55% believe that they will either work part time during their “retired” years (42%) or plan to never stop working (13%).

Some other interesting info:

- Semi-retirement is most prevalent in Asian countries; whereas 22% of U.S. citizens are semi-retired before full retirement, countries like Hong Kong, Singapore and Indonesia have a population of semi-retired people anywhere from 30-35%

- The majority of people actually retire earlier than they had planned to, mostly due to organizational changes in their job or personal health reasons

- Of those that stay on the job longer than expected, the main reason cited is because they enjoy what they are doing and see no reason to retire

Part of this shift in attitude could be explained by how ill-prepared many feel (and in truth are) for retirement. As we’ve discussed in previous posts, retirement savings in the US is severely lacking [average retirement account balances for those close to retirement (ages 56-61) is only ~$137,000]. As a result part-time work is a viable way to make up for income shortfalls. Indeed, of those that said they retired later than anticipated, the second-most popular response was because they needed the income. Unless this shifts, the definition of retirement will inevitably be different for the generations to come.