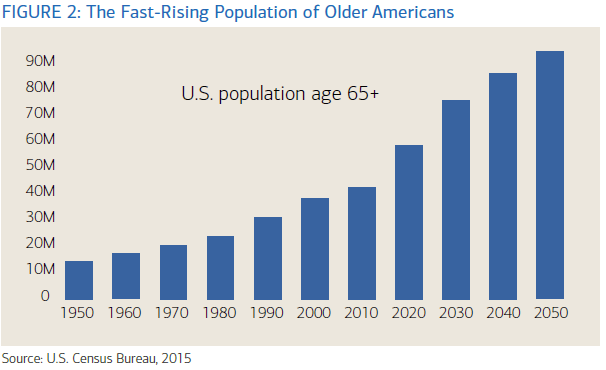

Three major forces are transforming the challenge of funding retirement. First, the massive Baby Boomer retirement wave is dramatically increasing the retiree population (FIG 2), adding about 10,000 new retirees a day. The U.S. population age 65+ will continue its dramatic rise, increasing by half over the next 30 years.

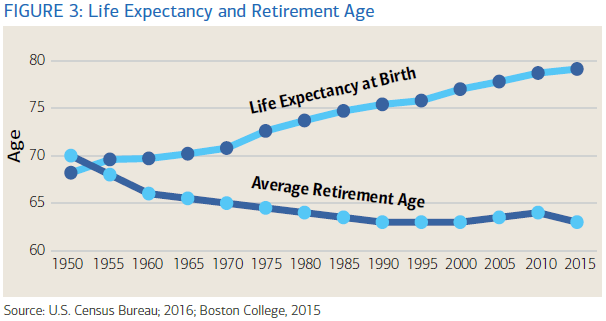

Second, longevity continues to climb. Average life expectancy at birth is up to 79 years and is projected to continue to rise, adding nearly two years per decade. However, the average retirement age is little changed (FIG 3). That means more retirees will need to fund longer retirements.

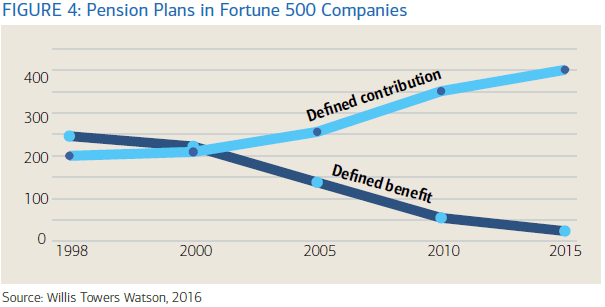

Third, the retirement funding formula is shifting dramatically. Most employers have discontinued guaranteed defined benefit pensions in favor of 401(k) and other forms of defined contribution accounts (FIG 4). And the long-term viability of Social Security benefits is in question.

What does this all mean? Americans need more funding for longer retirements, yet the “three-legged stool” traditionally used for funding retirement—Social Security, employer pension, personal savings—is getting very wobbly for many people. They will need to rely more on personal sources of income, and so the responsibility for managing retirement funding resides more than ever with the individual.