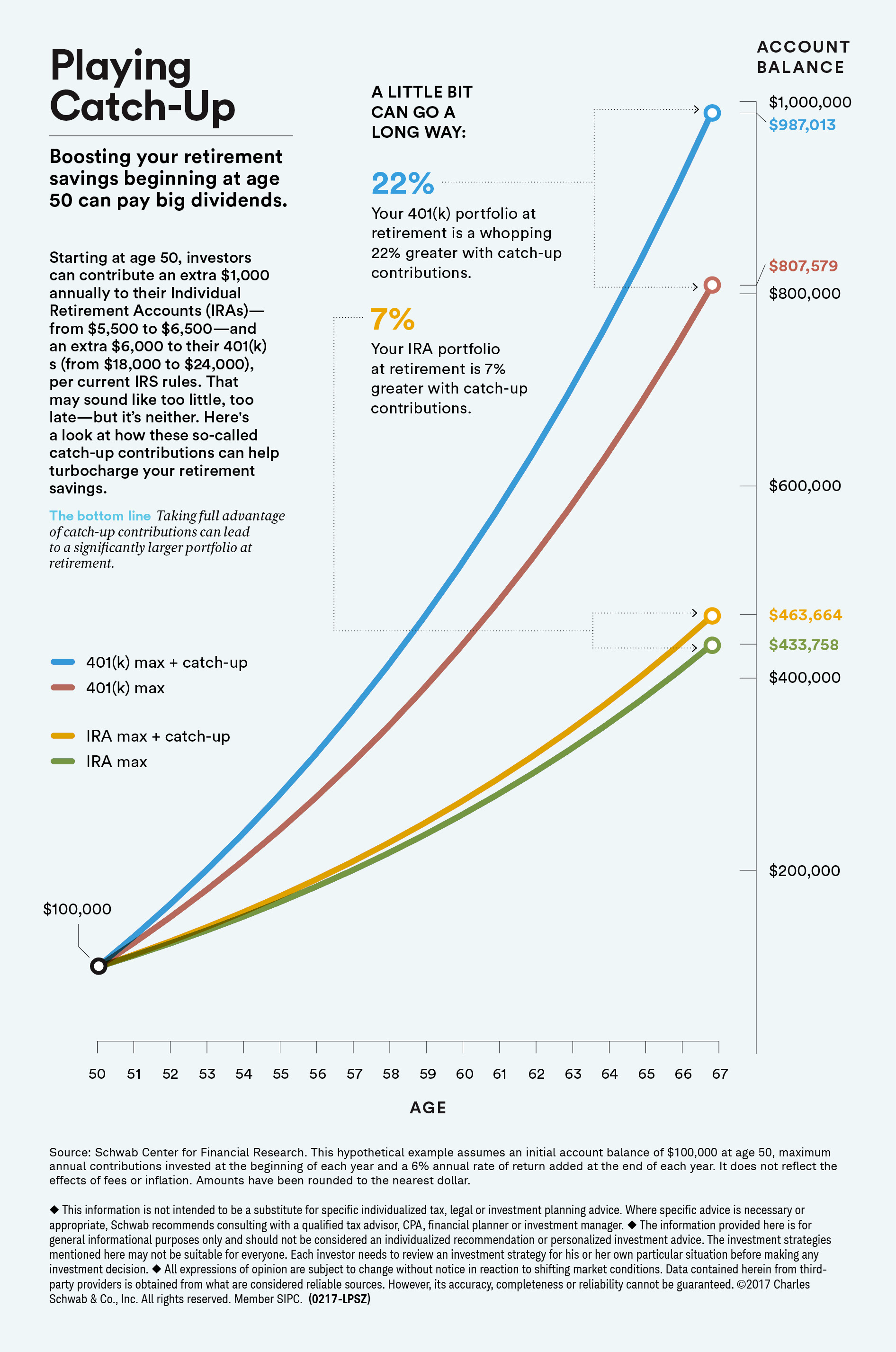

There are some advantages to getting older, especially if you are behind in your retirement savings. In the year you turn age 50 (and every year thereafter until retirement), individuals are allowed to make “catch-up” contributions to help boost retirement savings. In qualified retirement plans like 401(k)s, the catch-up amount is $6,000; for IRA accounts, the amount is $1,000. But how much does that boost in savings help?

According to the infographic below, a little can go a long way – 17 years of additional catch-up contributions lifts 401(k) balances by 22% and IRA balances by 7%. In the long run, that may equate to an additional year or more of retirement spending! So as you are reviewing your contribution percentages for next year, remember if you’ll be 50 or over in 2018 it pays to play catch-up.