Last week the Consumer Federation of America and the American Savings Education Council sponsored America Saves Week in an effort to raise awareness and get more Americans to do whatever they can to save. In conjunction, the following annual survey was released, highlighting the differences in saving between the genders.

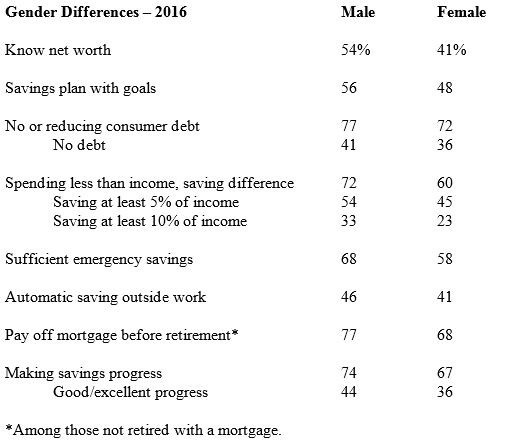

The survey pointed out a significant gender gap — 57 percent of non-retired men say they’re saving enough for that desirable retirement, compared to only 47 percent of non-retired women who feel that way. Women are worse off than men in a dozen separate measures of savings know-how. Less than a quarter of women are saving at least 10% of income, compared to a third of men.

I’m passing along the group’s main tips, applicable for any age and gender, for boosting your overall savings rate.

Step 1: Pay off consumer debt. Tackle high interest credit card debt first. Of those surveyed 38% said they had no consumer debt—key to starting an aggressive savings plan.

Step 2: Build an emergency fund. Whenever you’re faced with life’s unexpected expenses, an emergency fund can help you cover the costs without resorting to a credit card and putting yourself into unnecessary debt. Ideally, your fund should be able to cover anywhere between 3 to 6 months worth of expenses. While it might seem like a lot, getting your emergency fund out of the way will allow you to tackle your other savings goals from a place of security.

Step 3: Save in a workplace retirement plan. You might be automatically enrolled in your workplace retirement plan (like a 401(k)). If not, sign up, and contribute at least enough to get any match money your employer might kick in. If you’re already enrolled, you might be saving at a low 3%, the most common default. Try to bump up your contribution amount; if your employer offers auto escalation, it will be automatic.

Step 4: Make savings automatic. Ask your payroll administrator if they can direct a portion of your paycheck to a savings or brokerage account. Alternatively, ask your bank or credit union to help you set up automatic transfers from your checking account into savings. You can fund a new government myRA retirement account or an Individual Retirement Account that way. If you’re due a refund at tax time, direct at least part of it into savings.

Step 5: Pay down your mortgage. The most important way the American middle class has saved over past 50 years is by buying a house and religiously making mortgage payments, making them on time and even early. If you haven’t refinanced lately, look into it now, and use it as an opportunity to shorten the term of your loan. And don’t be tempted to borrow on the equity in your home.