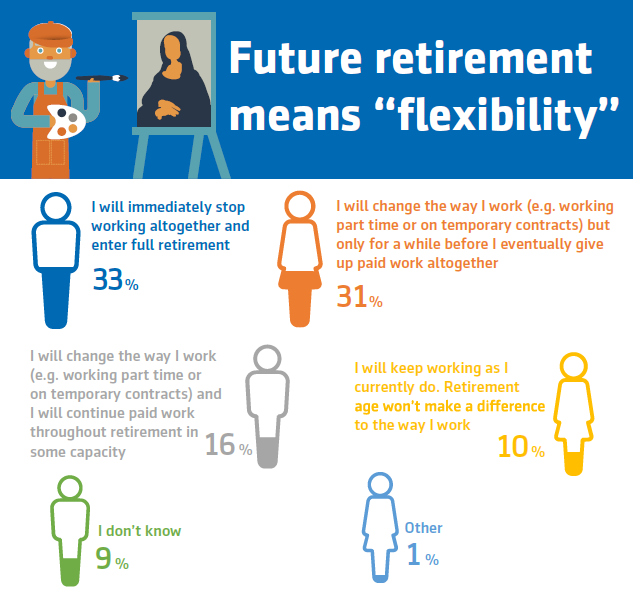

According to a recent Retirement Readiness Survey conducted by Aegon, among today’s workers, globally, only one in three considers retirement to be a moment when they immediately stop working and fully retire. Most workers (57 percent) envision continuing some form of work in retirement including 31 percent who plan to work part-time for a while before they eventually stop working altogether, 16 percent who will change the way the work (e.g., part-time, different capacity) but continue working throughout their retirement, and 10 percent who say that reaching retirement age won’t make a difference to the way they work.

With the exception of workers in Spain and France, workers who envision a phased retirement that involves continued work and/or a gradual transition far outnumber those who plan to immediately stop working among the 15 countries surveyed.

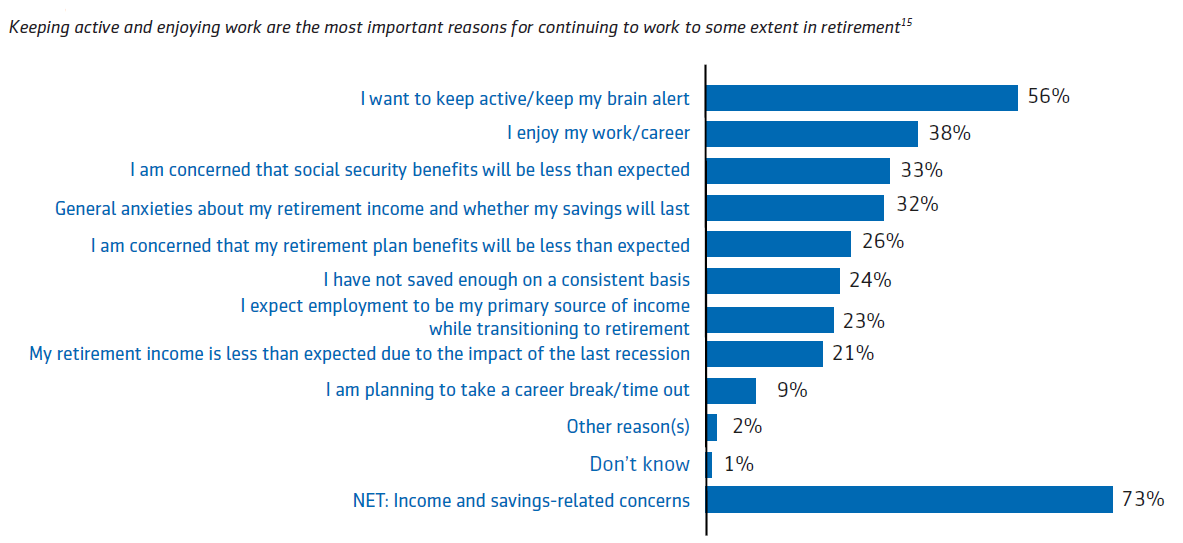

What is equally interesting about this redefinition of retirement is why it is appealing to more and more people. Obviously, a phased retirement could provide flexibility when it comes to retirement income planning, and on the net a variety of income and savings-related concerns are cited for continuing to work.

The 2 most important reasons given, however, have nothing to do with financial concerns. Globally, more than half (56 percent) want to keep active/keep their brain alert and 38 percent just simply enjoy their work. Among the countries in the survey, Brazilians (68 percent) are most likely to envision working in retirement to keep active/keep their brains alert while the Japanese (84 percent) are most likely to do so for income and savings-related concerns.

In countries around the world, people’s expectations for retirement are changing. With increases in longevity and the potential for healthy aging, today’s workers envision working longer and fully retiring at an older age. They view retirement as a transition which offers the promise of continued work albeit at a more relaxed pace with more time to enjoy life. However, their success largely depends on their health and financial ability to do so.