The Government Accountability Office (GAO) recently released its latest report on the state of the country’s retirement security. The Office was tasked to review what consumption looks like in retirement and how replacement rates are defined, calculated, and used to assess retirement preparedness. According to the report, it was their assessment that in order to help workers better plan for retirement, a more complete understanding of how much income actually needs to be replaced during those years is vital to that preparedness. Only then could a more accurate replacement rate for income, usually based on the individual’s unique situation, be calculated.

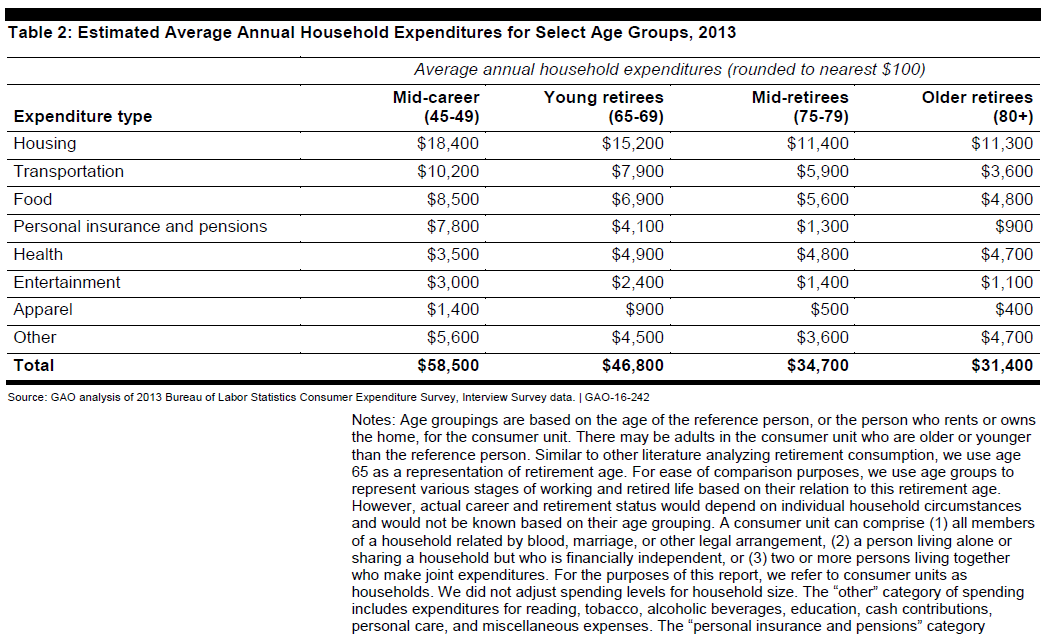

As one of their following table shows, a retiree’s income needs tends to vary as they age, but a few truths can be gleaned:

Regardless of what the experts say, how much money you’ll need in retirement depends on you. When planning ahead, consider how these 3 expenses can change:

Housing. Regardless of age, housing costs average about a third of household’s total expenses. Even so, housing costs can change over time—including before and during retirement. For example, paying off a mortgage or downsizing can save you money, while moving to a more expensive area or needing specialized senior housing can increase your costs.

Health care. Health care costs can go up or down. However, older households tend to spend more on health care than younger ones. In addition, insurance premiums and out-of-pocket costs can change over time.

Lifestyle. How do you want to spend your retirement? While you may not need to pay for your commute, with more free time you may spend more money on entertainment, dining out, or travel. Retirees may be able to stretch their dollars with senior discounts, but going out can still add up. Or you may choose a simpler lifestyle in retirement, staying in and spending less.

Source: http://blog.gao.gov/2016/03/22/retirement-savings-strategies-are-not-one-size-fits-all/