Putting your plan in writing makes planning for retirement less intimidating. It helps you see what steps you need to take, which builds confidence and makes it more likely you’ll follow through.

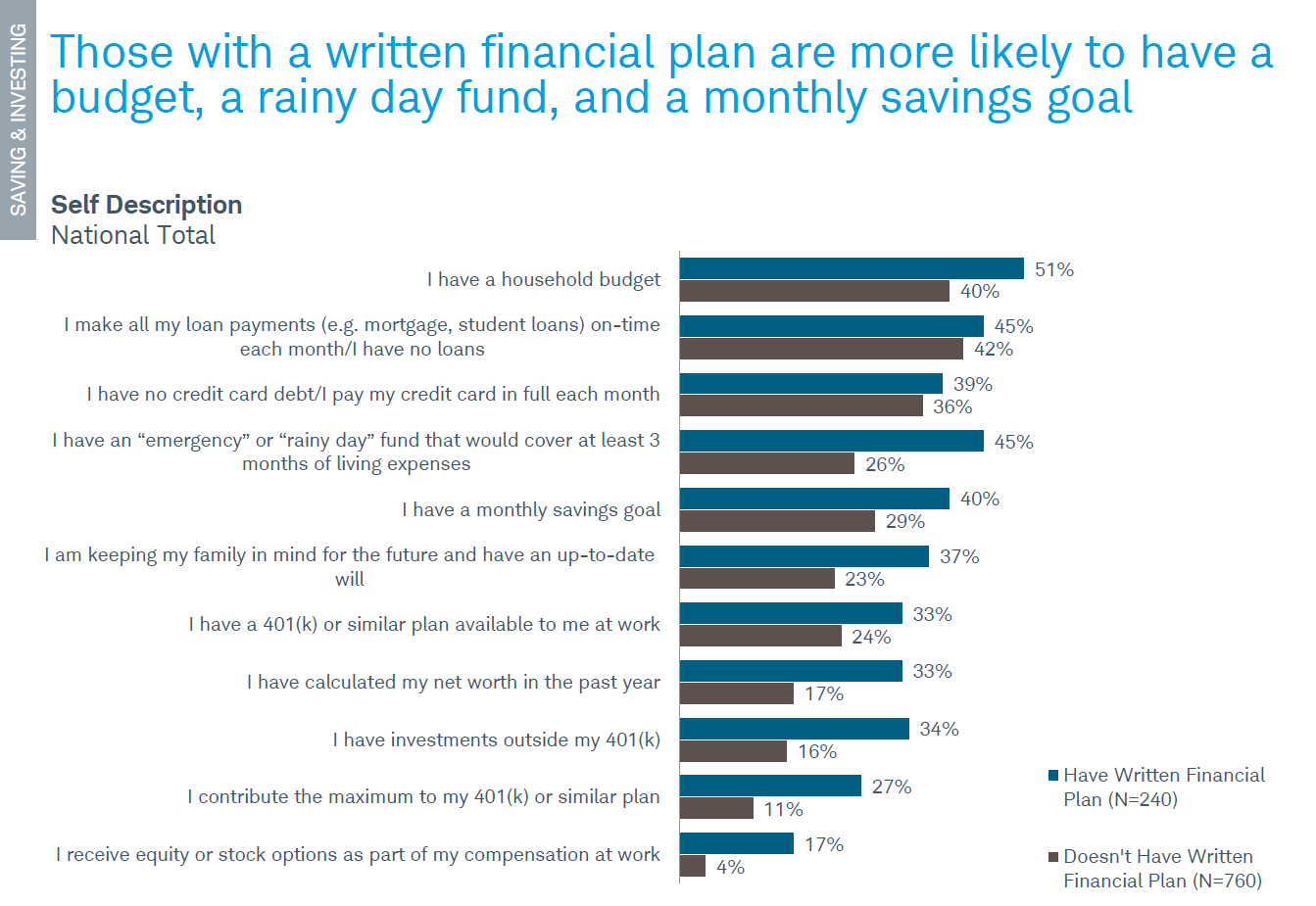

For example, a recent Schwab report shows that people who have a written retirement plan were 60% more likely to increase their 401(k) contributions and twice as likely to stick to a monthly savings goal than people without such a plan.

Unfortunately, not enough people go to the trouble of putting pen to paper (or, as is more likely the case today, fingers to keyboard). According to the Schwab study, only 24% of Americans say they have a financial plan in writing.

Which is a shame, because it’s not as if you have to produce a magnum opus to significantly improve your shot at a secure retirement. Documenting key decisions, such as committing to a target annual savings rate, choosing (and then following) a long-term investment strategy, and dedicating time to check-up on your plan are a great place to start. As the results below show, having a written plan means you are more likely than those that don’t to create the good financial habits that will make your retirement successful.