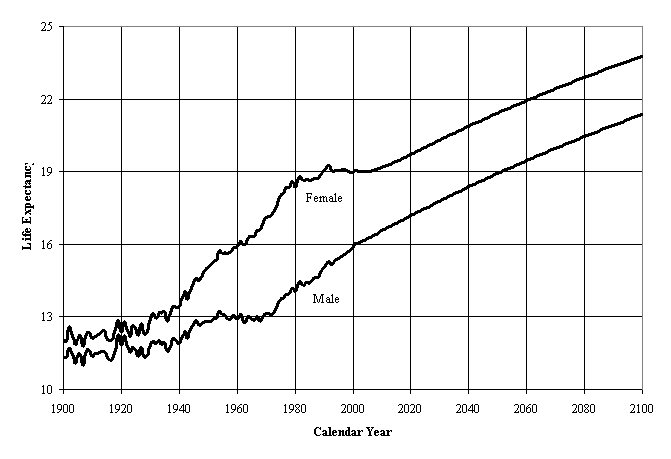

According to Social Security Administration data, Americans have steadily lived longer and longer lives. The chart below shows how many more years, on average, a 65-year-old American has lived since 1900, as well as the expectations that this trend will continue to the end of the current century.

For today’s seniors, this means most men who reach 65 will live another 17 years, while the average 65 year-old woman will live around 20 more years.

The amazing news is that two decades of retirement — assuming a retirement age of 65 — is a lot of time to spend with family, travel, and otherwise pursue passions and activities that may not be compatible with full-time work. But it also requires a significant amount of money to pay for that many years without a steady paycheck. For instance, if you need to generate $50,000 per year in income from your retirement savings, you’d need to have a $1.25 million nest egg, based on the 4% retirement rule (which has flaws, but is a starting point).

The idea of having to save up so much money is daunting. However, there’s a big difference between saving $1.25 million and building a $1.25 million portfolio over the long term. For example, if someone started contributing 7% of their salary (with a starting salary of $50,000) in their retirement account at age 25 and invested in a low-cost S&P 500 index fund, they would have a $1.25 million retirement portfolio at age 59, based on the market’s historical 10% average rate of return.

The best part? Their total contributions would be around $175,000. That’s the power of compound growth over a very long period of time.

The point is, invest — don’t just save — for retirement. Start as early as possible, and contribute as much as possible.